Record Number of Total Vehicle Losses in Hurricane Irma’s Wake!

Appraisal Engine Inc. offers second opinion on insurance adjusters’ estimates

Industry experts estimate that flooding caused by Hurricane Irma damaged up to as many as a 30,000 cars in Florida. It will be up to owners and insurers to decide what to do with the vehicles, leaving many insurance adjusters swamped.

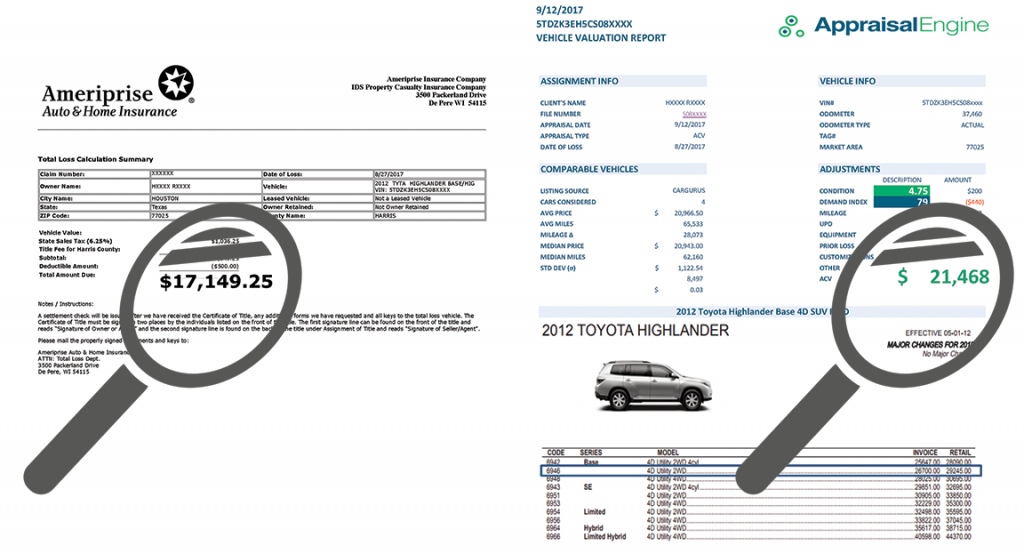

Appraisal Engine offers a total loss claim review for vehicle owners who want a second opinion after hearing their insurance company’s offer.

Flooding often causes severe damage to cars. Damaged parts include anything from the engine and the interior to electrical connectors, wiring and computer chips. In some cases, the damage may not surface for years.

Experts predict that the hurricane and its aftermath destroyed more vehicles than any other natural disaster in the country’s history. That’s likely to make it a record number of total losses for insurance adjusters.

When are vehicles totaled in Florida?

According to Florida F.S.A. § 319.30(1)(t) and F.S.A. § 319.30(3)(a)(1)(a)(b) a vehicle is declared a total loss when it is wrecked or damaged and the cost, at the time of loss, of repairing or rebuilding the vehicle is 80 percent or more of the cost to the owner of replacing the wrecked or damaged motor vehicle or mobile home with one of like kind and quality.

Owners who carried comprehensive insurance will get paid for the value of the vehicle minus their deductible. That value, however, may be less than the owner believes the car is worth.

Appraisal Engine Inc. gives owners an option. A total loss claim review is a full analysis of an insurance claim and an examination of a vehicle’s value. That includes an assessment of the insurance company’s total loss offer.

Policyholders have a tool to fight back, the policy’s appraisal clause:

Florida auto insurance policies include an appraisal clause that states, if the insurance company and vehicle owner don’t agree on the amount of loss, either party may demand an appraisal. Each party selects appraisers who, if they fail to agree, submit their differences to an umpire whom they select.

Vehicle owners may start the process by contacting Appraisal Engine Inc. Its senior appraiser, Tony Rached, is a licensed Florida insurance adjuster who has more than 14 years of experience in dealing with losses similar to what’s being seen in Florida. Rached has appraised more than 15,000 cars.

The company offers a $50 total loss claim review and a $150 vehicle valuation report. There is an additional cost if the company negotiates a claim on behalf of the insured.

Appraisal Engine has launched a special

Florida hotline because of the extent of the damage. The company can be reached by calling the hotline at 305-981-6785 or the corporate number at 1-877-667-2326.

Get Started with a Total Loss Claim Review.

Oops! We could not locate your form.