Why That’s One of the Most Wrong Arguments in 2026

If you were in an accident, had your vehicle repaired, and then heard this from the insurance company…

“Your car was fixed properly, so there’s no diminished value.”

…you’re not alone.

This has become one of the most common ways insurers try to shut down a diminished value claim before it even starts. And in 2026, with vehicle history data being more visible than ever, that argument is weaker than it’s ever been.

In this article, you’ll learn:

Why a repaired vehicle can still lose market value

What insurers don’t want to admit about accident history

How to prove diminished value even after “perfect repairs”

What steps to take if your claim is denied

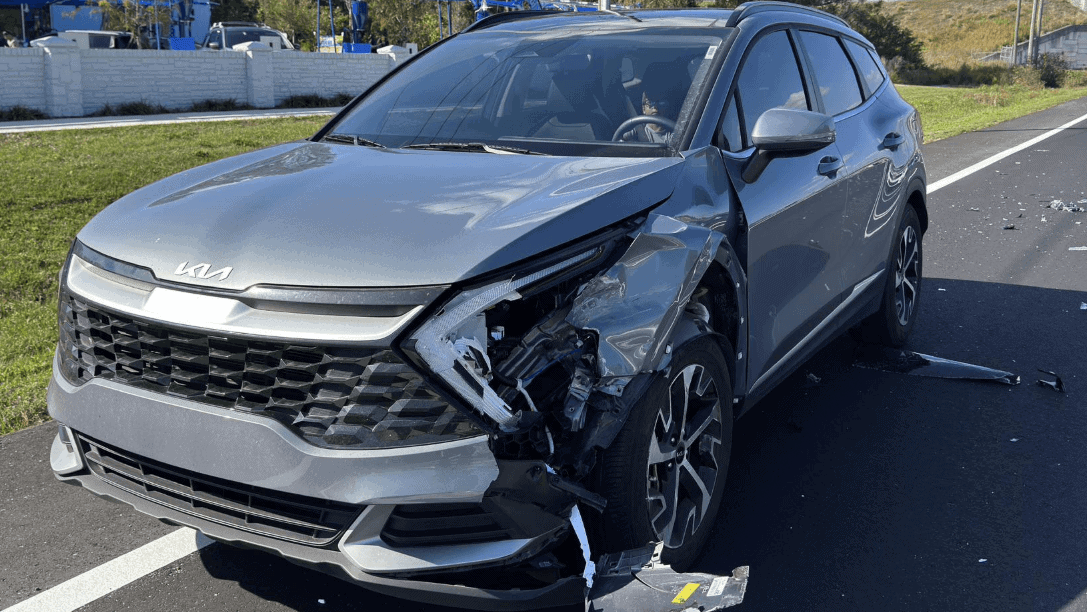

The Problem: Repairs Don’t Erase Accident History

Let’s be clear:

A body shop can repair metal.

It can repaint panels.

It can restore function.

But repairs cannot erase the fact that your vehicle now has an accident record.

Buyers don’t pay the same for a car that was in a crash, even if it looks flawless. Dealers don’t offer the same trade-in value. And resale platforms don’t treat it the same.

That’s diminished value.

Appraisal Engine explains this clearly in its guide on how accident history affects resale worth.

What’s Really Happening Here

Problem

The insurer claims repairs restored full value.

Agitation

But when you try to sell or trade the car, offers drop instantly. Suddenly, you’re losing thousands.

Solution

A diminished value appraisal proves the loss is real, measurable, and market-driven.

That’s exactly why insurers push this argument: because it works on people who don’t realize the market doesn’t care how “good” the repair was.

The Truth: Diminished Value Is About Perception and Market Behavior

This form of DV is often called stigma damage.

Even the best repair cannot remove buyer hesitation.

Appraisal Engine covers stigma damage directly in what stigma damage means for diminished value.

A clean-title vehicle sells faster and higher.

A vehicle with a Carfax accident entry sells lower.

That difference is diminished value.

Why the Insurer’s Logic Fails

Situation

Your vehicle was damaged but repaired.

Problem

Insurers claim “factory-quality repairs restore value.”

Implication

If that were true, two identical cars (one clean, one wrecked) would sell for the same price.

They don’t.

Need-Payoff

That’s why professional diminished value documentation becomes the difference between:

accepting the insurer’s lowball offer

orrecovering the compensation you’re actually owed.

Why Insurers Use This Argument So Often

Insurance companies know most drivers don’t understand DV law or valuation.

This is listed as one of the top loopholes insurers use to avoid paying diminished value in common insurance loopholes that block DV claims.

The goal isn’t accuracy.

The goal is closure.

Fast claims. Minimal payouts. No disputes.

The Market Proves Repairs Don’t Restore Value

Vehicle history reports are permanent.

Platforms like Carfax make accident disclosures unavoidable through vehicle history reports that buyers check instantly.

And industry valuation tools like Black Book confirm that accident history affects pricing trends across the market in current used-car market insights.

In 2026, buyers are more informed than ever, which means diminished value is more measurable, not less.

How to Prove Diminished Value After Repairs

If your insurer denies DV because your car was “well repaired,” here’s what you need:

1. An Independent Diminished Value Appraisal

Not one from the insurance company.

AE explains the documentation process in how to document diminished value properly.

2. Vehicle History Evidence

Carfax or AutoCheck showing the accident entry.

3. Comparable Market Pricing

Same car, same mileage, but clean history vs accident history.

4. A Strong Submission Package

Organized proof beats assumptions.

Final Takeaway: “Proper Repairs” Is Not a DV Denial

A repaired car can be mechanically perfect and still lose resale value.

Diminished value exists because the market reacts to accident history, not because repairs were incomplete.

So when an insurer says:

“There’s no diminished value because it was repaired correctly”

What they really mean is:

“We hope you don’t know how DV actually works.”

And now you do.

Want a printable version of this guide?

Download the full PDF here: Click here to download the PDF version of this article