Unlocking Fair Compensation: Navigating Diminished Value Claims in Florida

In the aftermath of a vehicular mishap, unraveling the intricacies of Diminished Value Claims in Florida becomes paramount for securing equitable compensation. Within the confined four-year window for tort claims in the state, this guide offers a unique roadmap to optimize your chances of receiving the compensation you deserve.

Delving into the nuances of these claims, we present a distinctive, step-by-step process that equips you to traverse the complexities of diminished value claims. This resource empowers you to make the most of the crucial timeframe at your disposal.

Diminished Value Claims in Florida (PDF)

Understanding Diminished Value

Diminished Value, synonymous with Loss in Value, encapsulates the reduction in the resale worth of a vehicle stemming from a collision or other incidents like fire, flood, or hail. While automobiles naturally depreciate, an accident expedites this process, leading to an immediate plunge in market value.

In Florida, drivers have the right to seek compensation for the diminished value (DV) of their vehicles post-accident. This compensation hinges on the belief that a prudent consumer would hesitate to pay full value for a vehicle with an accident-laden history.

Types of Diminished Value

- Inherent Diminished Value: The prevalent type, signifying the foundational loss of value due to an accident in the vehicle’s history.

- Immediate Diminished Value: Arising from damages that promptly decrease the vehicle’s value, regardless of repairs.

- Repair-Related Diminished Value: Emerges when subpar repairs hinder the vehicle from being restored to an acceptable condition.

Filing a Diminished Value Claim in Florida: A Strategic Approach

Initiating a diminished value claim in Florida places the responsibility on you to furnish incontrovertible proof to the at-fault driver’s insurance company. To adeptly navigate this process, collaboration with an expert is indispensable—someone not only licensed but also seasoned in handling diminished value claims.

Here’s a strategic breakdown of the steps to follow:

-

Connect with the Insurance Company

Open communication with the insurance company to understand their specific processes and the prerequisites for filing your claim.

-

Request a Comprehensive Claim Review

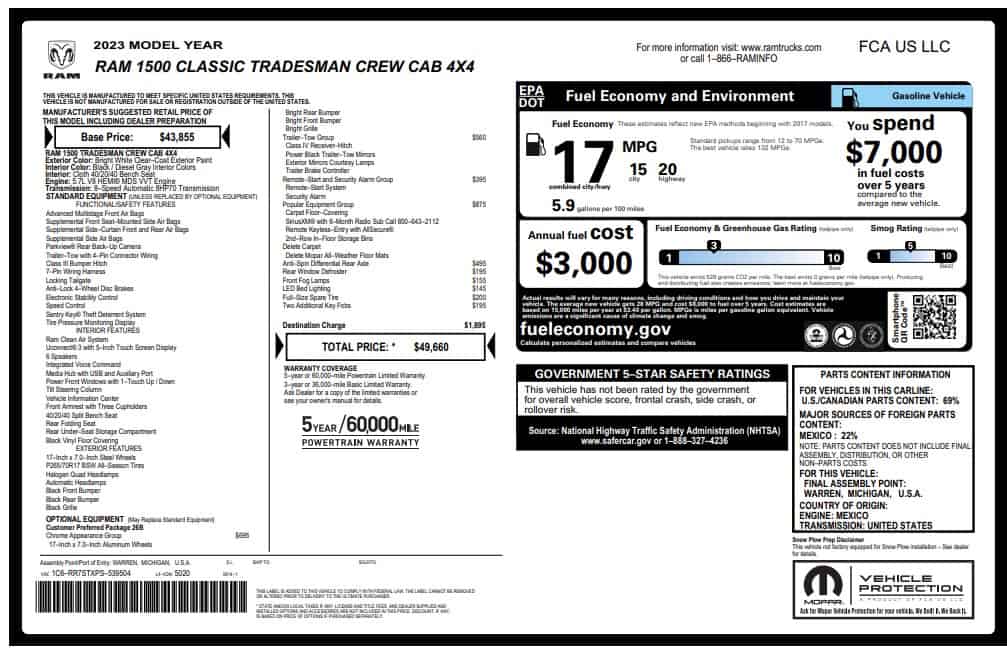

Upon determining that your case aligns with the diminished value process, the next pivotal step is securing a Free Claim Review. While the provided quote can’t directly support a DV claim, it imparts knowledge about your vehicle’s actual value.

-

Secure a Certified Appraisal

With the estimate in hand, obtaining an appraisal from a licensed vehicle appraiser, like Appraisal Engine, becomes imperative. This certified document meticulously outlines your car’s actual value, considering factors such as its condition, history, and prevailing market trends.

-

Submit the Report and Demand Compensation

The final stride involves submitting the certified appraisal report to the insurance company alongside a formal demand for compensation. This comprehensive documentation serves as the linchpin, substantiating your diminished value claim.

If you have any questions about Florida Diminished Value Claims or if you seek a FREE claim review, dial (877) 667-2326. Alternatively, fill out the form below to discover the amount owed to you by the insurance company. We stand ready to guide you through every facet of your diminished value claim.

FREE Diminished Value Claim Review

"*" indicates required fields