Used Car Prices Surge, Driving Up Overall Inflation Rate (PDF)

Over the past three years, used cars have exerted a significant influence on inflation dynamics in the United States. In 2020, the presence of used cars thwarted the occurrence of disinflation for several months. Furthermore, in June 2021, as inflation gained momentum, used cars constituted one-third of the year-on-year inflation rate.

Throughout that summer, manufacturers encountered difficulties in acquiring parts and chips necessary for new cars, with uncertain knowledge regarding the scope and duration of these supply chain challenges. As October approached, economists acknowledged that the economy’s overall supply problems would contribute to enduring inflationary pressures, resulting in price hikes across multiple sectors beyond the used car market. As a result, inflation ceased to be solely influenced by the dynamics of the used car industry.

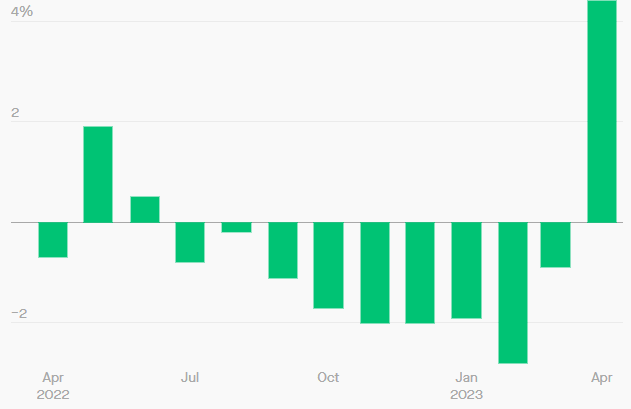

The latest Consumer Price Index report has registered a 4.4% jump in used car prices, ending a nine-month streak of decline and subsequently driving up the overall inflation rate. This hike was consequent to upgrades in wholesale car prices that were not at first included in earlier CPI estimations, appearing in April’s statistics (the index falling behind private sector price gauges). Yet, new evidence suggests that prices had already begun to drop off by April, likely leading to lower amounts of used car inflation visible on future CPI reports. In any case, year-on-year figures still signify a 6.6% reduction.

Used Car Inflation in the US

Used car prices in the US will drop again in the near future

Nevertheless, the inflationary outlook is no longer solely reliant on used cars. Declining prices of new cars and discounted services, including transportation and medical care, have contributed to the stabilization of the CPI data. As a result, the annual inflation rate has decreased from 5% in March to 4.9% in April.

As new car purchases regain strength and consumers utilize their income tax refunds, it is expected that the used car market will experience a cooling effect once again. This can be attributed to increased demand in the new car market and consumer spending patterns.

Additionally, excluding used cars and auto insurance from the core inflation measure, which is a significant indicator that excludes the volatility of energy and food prices, would result in a mere 0.2% increase. This is lower than the 0.4% anticipated by economists and underscores the impact of these factors on inflation trends.