The landscape of the U.S. automobile retail sector is undergoing a significant transformation, with recent trends pointing towards decreasing new vehicle margins. This development, while presenting challenges for auto retailers, signals potentially advantageous conditions for individuals in the market for a new car. Amidst a period characterized by increased production and strategic pricing adjustments, this shift diverges markedly from the previous climate of elevated prices and scarce availability due to supply chain disruptions. This article delves into the nuances of this evolving scenario, exploring what it means for consumers and the broader industry alike.

Take Advantage of Falling New Vehicle Prices (PDF)

Understanding the Margin Decline

At the heart of the retail automotive industry’s current predicament are the diminishing margins on new vehicles. Key industry players report that the introduction of discounts and incentives, aimed at attracting buyers, is eroding the profitability that dealers and manufacturers once enjoyed. Insights from a recent Cox Automotive analysis highlight a persistent uptick in such promotional activities, exerting downward pressure on both prices and profit margins.

The Role of Production Increases

A notable increase in vehicle production has served as a catalyst for the reduction in dealer margins. This ramp-up in manufacturing has somewhat mitigated the supply shortages that have plagued the industry, altering the dynamics of pricing and dealer leverage. While this shift poses financial challenges for retailers, it opens the door for buyers to secure more favorable deals on new vehicles.

Financial Indicators and Market Reactions

The financial implications of these trends are evident in the latest earnings reports from major auto retailers. For instance, AutoNation’s CEO, Mike Manley, noted a relatively modest reduction in vehicle margins, amounting to around $120 per month in the last quarter. Similarly, Lithia Motors observed a decline in its new vehicle margin to 7.9%. These figures highlight the financial strains facing retailers, despite efforts to bolster profits through enhanced after-market services, where the increasing complexity of vehicle technology plays a significant role.

Investor Sentiment

The investment community’s reaction to these developments has been mixed. Sonic Automotive experienced a decline in its share price following underwhelming fourth-quarter results, illustrating investor apprehension. On the other hand, slight fluctuations in the share prices of AutoNation and Lithia Motors reflect a more nuanced investor outlook on the sector’s prospects.

Implications for Consumers

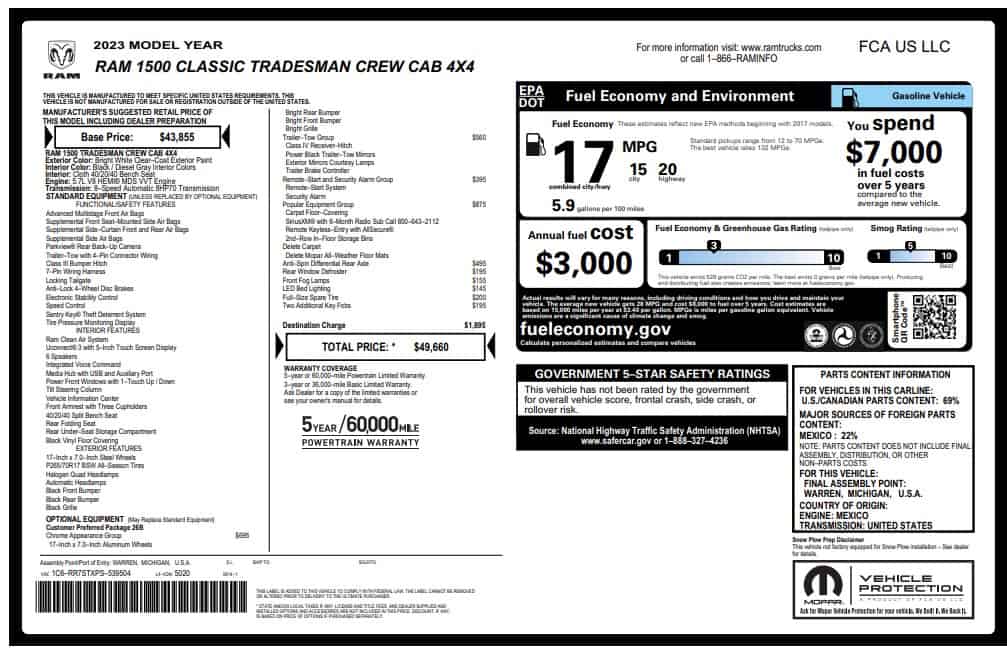

For potential car buyers, the evolving auto retail environment presents both opportunities and challenges. The advent of more substantial discounts and incentives could lead to more attractive pricing and negotiation leverage. However, the shift towards a more competitive and complex market, especially with the advent of EVs, necessitates a well-informed approach to vehicle purchasing.

Conclusion: Steering Through a Shifting Market

As the dynamics of the U.S. auto retail industry continue to evolve, adaptation will be crucial for both dealers and consumers. Retailers may increasingly focus on after-sales services and the burgeoning EV market to recoup lost margins, while consumers stand to benefit from the competitive landscape through better deals. Nevertheless, with the pace of sales moderating and the industry adapting to new realities, staying informed and flexible will be key to navigating the future terrain of car buying and selling in the United States.