New Car Prices Decline as ATPs Fall Below Average MSRP (PDF)

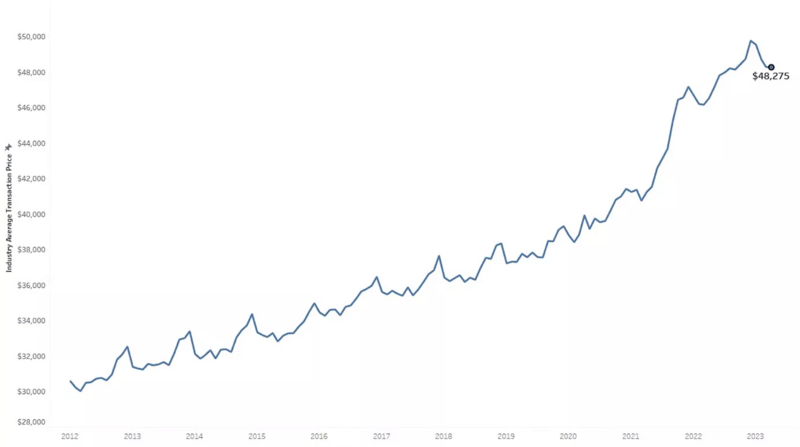

In the month of April, the United States witnessed a modest decrease in the average transaction price (ATP) for new vehicles, signifying a continuation of the trend where the ATP has fallen below the average manufacturer’s suggested retail price (MSRP) for two consecutive months.

According to data provided by Kelley Blue Book, the ATP for new vehicles sold in the U.S. last month fell by a mere 0.03% compared to March, settling at $48,275. Although the decrease may seem small, it represents a notable shift from the previous 20 months during which new vehicle ATPs consistently exceeded the average MSRP.

In more specific terms, April’s ATP fell $378 short of the average sticker price, whereas in April 2022, it exceeded the sticker price by $600. This development brings good news to prospective car buyers on the lookout for a new vehicle.

Upon examining the data provided by Kelley Blue Book, an intriguing picture emerges. In April, the average transaction price (ATP) for non-luxury vehicles climbed to $44,750, showcasing a noteworthy increase of $461 compared to March 2023. This represents a significant year-over-year growth of 5.2%. However, despite this positive trajectory, the ATP remained $381 below the average MSRP.

In contrast, luxury vehicle buyers experienced a contrasting scenario. They witnessed a considerable decline in the ATP, plummeting by $1,605 from March 2023 to reach $64,144 last month. Remarkably, this is the first instance in 11 months that the ATP for luxury vehicles has dipped below the $65,000 mark.

Even more substantial was the decline in the average price paid for new electric vehicles. The ATP for new EVs sold in April amounted to $55,089, representing a considerable 7.5% decrease or $4,464 less than in March. Comparing it to April 2022, the drop amounts to an impressive $10,096.

The Impact of Incentives and Market Outlook

Rebecca Rydzewski, the research manager of Economic and Industry Insights at Cox Automotive, commented on the downward trend in new-vehicle transaction prices for 2023. She emphasized that this shift comes as a breath of fresh air for buyers after years of limited supply and rapidly increasing prices. Rydzewski noted that the market is now responding to the climbing inventory levels and enhanced manufacturer incentives. However, she acknowledged that high auto loan interest rates continue to pose a significant challenge for many buyers. Nevertheless, the current inventory and price trends present a positive outlook for the market.

Additionally, the increased supply of new vehicles has allowed car manufacturers to raise incentives. Kelley Blue Book reported that incentives averaged $1,714 in April, marking a $170 increase compared to March and accounting for 3.6% of the average transaction price.