How Can the Inflation Reduction Act Reduce the Cost of EVs? (PDF)

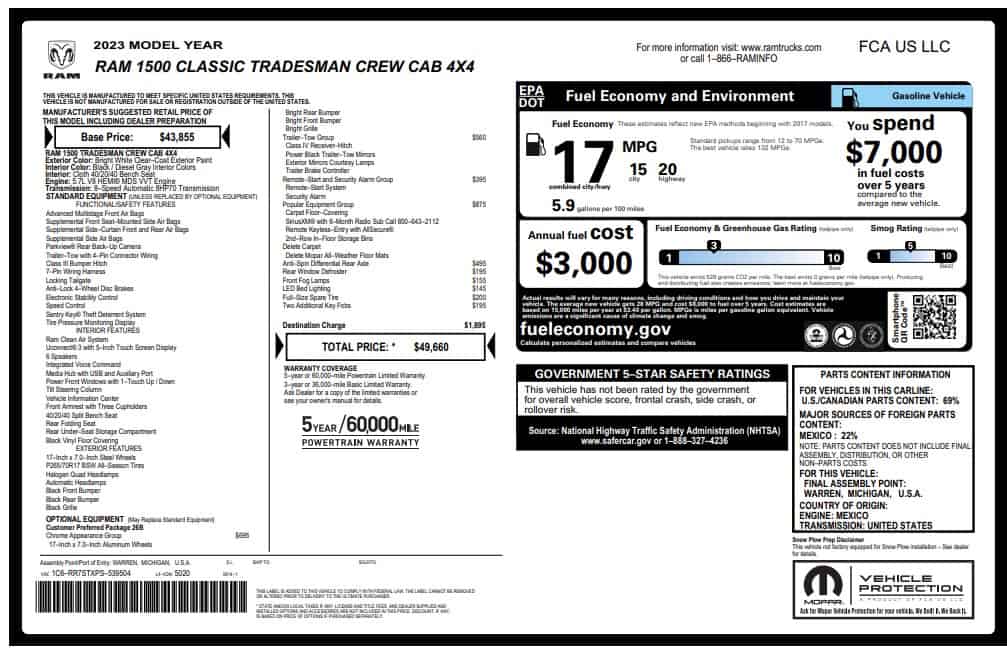

More than ten years ago, the federal government began offering a tax credit to buyers of new electric vehicles in order to increase interest and make EVs more affordable. A new credit for buying clean energy vehicles was added when President Biden signed the Inflation Reduction Act (IRA) last fall.

While the IRA has new restrictions, buyers can still collect up to $7,500 when purchasing certain new electric or plug-in hybrid vehicles. Used EV buyers can even collect credit.

Aside from helping boost EV sales, this legislation also helps to reduce the cost of future EVs. This cost reduction is related to one of the most expensive aspects of building electric vehicles – batteries.

Appraisal Engine reports that industry experts agree the ultimate goal is to reduce battery production costs to $100 per kilowatt-hour or less by 2021. In November 2021, Bloomberg estimates that the average cost for the industry was $132/kWh. With raw material prices rising, this price is likely to have increased over the past year.

An Advanced Manufacturing Production Credit is provided in section 45X of the IRA. As part of this section, credit is granted for the production and sale of solar, wind, inverter, and battery components produced and sold domestically, as well as 10% of the cost of critical minerals – 50% of which are credited to the IRA. Minerals must be mined or processed in the United States or in a country with which the US has a free trade agreement. They can also be sourced through recycling.

Section 45X provides a generous tax credit for those who manufacture battery cells and modules in the US, offering $35 per kWh for battery cells and $45 per kWh for battery modules. Ion Yadigaroglu, a US clean-tech investor, commented on this to Bloomberg Green, saying that with this incentive program, one could recover more than a third of the cost of making a pack within the 10-year span of the IRA – potentially even covering its entire cost.

With this credit available primarily for batteries produced in America, car companies have a much higher incentive to build their own battery production facilities. This has already been seen by GM in partnership with LG and Ford and Tesla. In addition to the credits towards production, in-house factories reduce reliance on third-party battery producers and keep profits within the company.