How Are Auto Dealerships Adapting to Online Sales & EVs (PDF)

In recent years, the public perception of automotive dealerships has taken a hit. The question arises: what lies ahead for this business model? One crucial aspect that significantly influences how customers perceive a brand is the dealership experience. Unfortunately, many dealerships fail to reflect the brand values of automakers, and price gouging has become a rampant issue, particularly with cars in high demand and limited supply. So, how did we reach this point, and why don’t manufacturers sell cars directly to consumers?

The Role of State Auto Franchise Laws

To understand the situation, we must first delve into State Auto Franchise laws. These laws prohibit manufacturers from selling new cars directly to consumers or providing aftersales services. They also protect dealerships by enforcing exclusive territories and making it challenging for manufacturers to terminate dealership agreements. The states’ intention behind these laws is to safeguard local businesses and maintain competition among dealers. Unfortunately, the current scenario of inflated prices is a consequence of the supposed “free market” allowed by these laws.

However, the dealership landscape has evolved beyond being solely “local businesses.” In the United States, three enormous dealership chains—CarMax, Penske Automotive Group, and Lithia Motors—have acquired smaller, family-owned dealerships, achieving massive scale. These industry giants dominate the market, challenging the notion of dealerships as small, local enterprises.

Decoding the “Suggested” Retail Price

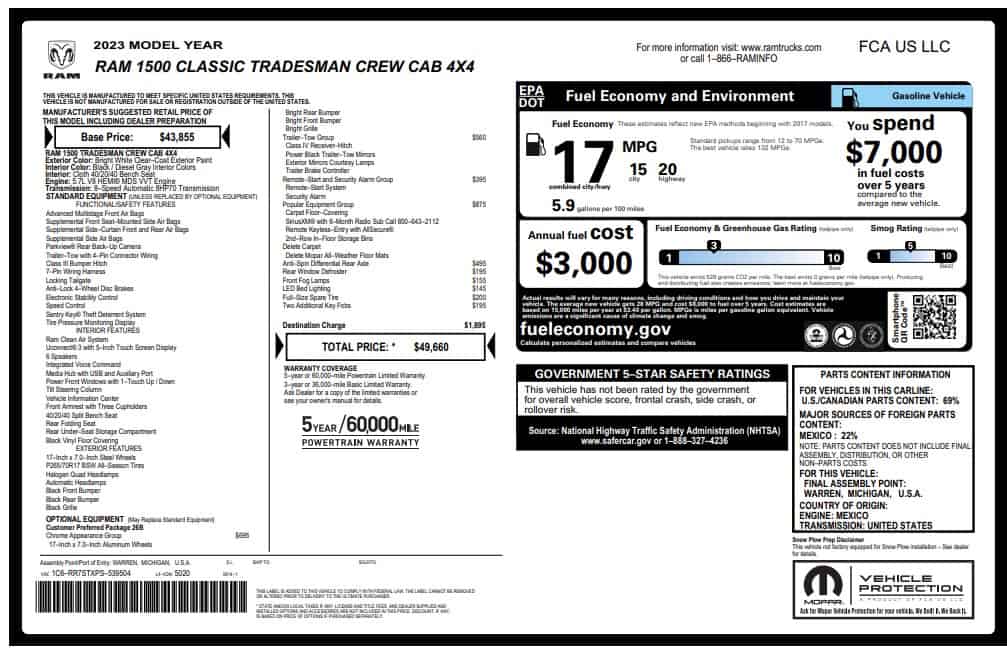

To comprehend why dealerships often face public disdain, we need to examine the Manufacturer’s Suggested Retail Price (MSRP). The MSRP itself is not inherently problematic, as it represents the cost of building the car, including manufacturing overhead, while allowing for a reasonable dealer profit.

Behind the scenes, dealerships purchase fleets of brand-new vehicles at wholesale prices, which are below the MSRP due to bulk buying. While certain details remain undisclosed, some websites can provide insights into the invoice price—the amount the dealer paid the factory for the car. Armed with this information, customers can negotiate the price starting from the invoice price.

Negotiation plays a significant role in transactions. If a car is produced in high quantities and demand remains stable, such as an entry-level 2023 Toyota Camry with an MSRP of $26,220 for the base LE model, customers can expect to pay at or below the MSRP when dealerships have an ample supply in their lots. On the other hand, for highly sought-after vehicles with limited production, like the 2023 Lamborghini Aventador, customers are likely to pay well above the MSRP.

However, paying above the MSRP doesn’t always mean exceeding the suggested price set by the manufacturer. This situation can arise even with cars produced in large quantities. For instance, a dealer may sell a base vehicle for $20,300 but attempt to convince the customer to purchase unnecessary accessories or insurance, resulting in a higher final cost. Such practices can leave customers realizing they paid more than the MSRP for a small crossover SUV with repair costs that may be lower than the added insurance.

The Future of Dealerships

As vehicle inventories gradually stabilize in the post-COVID era, we can anticipate a reduction in high markups. However, it is important to recognize that high transaction prices may continue to prevail for a considerable period. This understanding stems from a closer examination of dealership inventories. A study by BCG reveals that the repercussions of the pandemic-induced new car shortage will persist for several years to come. While inventories are projected to stabilize, they are unlikely to reach pre-pandemic levels. Consequently, dealerships find themselves with less motivation to provide discounts on new vehicles.

Simultaneously, due to the scarcity of new cars, a considerable 59 percent of purchases in 2022 were made-to-order, allowing customers to specify their desired color, features, and trim. This trend provides the luxury of time to customers but also presents an opportunity for dealers to increase prices by upselling optional features. As a result, customers generally pay at least the MSRP for their custom-ordered cars.

Online Sales and Electric Vehicles: A Double-Edged Sword

While online retail sales are gaining traction, purchasing new cars online remains relatively low, at just 0.5 percent in 2020. However, dealerships have invested in online services such as home vehicle delivery and delivering test drives to customers’ houses. Carvana, an online used car shop, is known for its “no haggle, no hassle” pricing model. Their transparent pricing approach, showing the final price without hidden markups, is a welcome change in an era of high markups.

The rise of electric vehicles (EVs) presents both opportunities and challenges. Tesla stands out as an automaker that directly sells to consumers, bypassing the traditional dealership model. Their pricing reflects the actual cost, which has not been well-received by dealerships and certain U.S. states.

Moreover, dealerships rely on aftersales services for profits, but EVs require less maintenance compared to internal combustion engine (ICE) cars. This reduction in aftersales revenue, combined with the expensive challenge of adapting service centers for EVs, further compounds the dealerships’ predicament.

Despite the changes ahead, the dealership model is expected to persist in the future, albeit in a transformed state. The industry will undergo a significant reshaping fueled by digitalization and the shift toward electric vehicles (EVs). If vehicle demand and inventory levels stabilize down the line, customers may once again have the opportunity to negotiate prices below the Manufacturer’s Suggested Retail Price (MSRP).