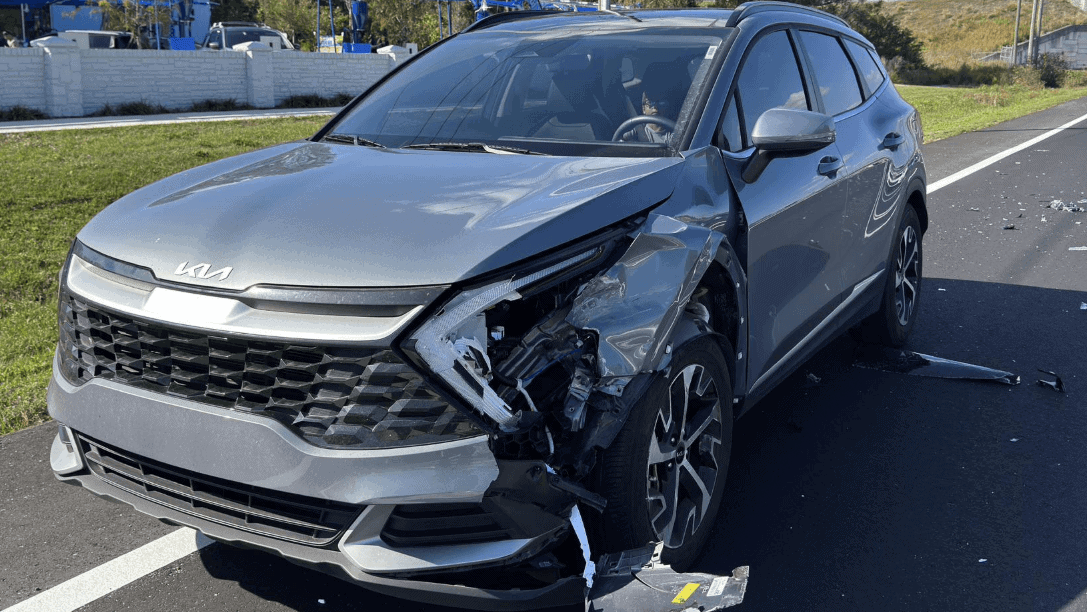

Not all vehicles lose value the same way after an accident.

In 2026, the used-car market is moving back toward historical depreciation patterns, and that shift is making diminished value losses more visible and more measurable. Buyers are once again paying closer attention to vehicle history, and accident stigma is translating into real dollar differences across vehicle segments.

This breakdown shows how diminished value varies by vehicle category, using current market behavior and depreciation trends as context.

Why Vehicle Segment Matters More in 2026

Diminished value is not just about the accident itself. It is about how the market reacts after the accident becomes part of the vehicle’s history.

According to current used car depreciation trends in 2026, price sensitivity is increasing across most segments. As supply normalizes and incentives return, buyers are less willing to accept any form of negative history at full price.

That shift is making post-accident value loss more pronounced, especially in certain categories.

Diminished Value Loss by Vehicle Segment (2026)

Below is a data-driven overview of how different vehicle segments typically perform after an accident, expressed as average percentage loss from pre-accident market value.

Table 1: Average Diminished Value Impact by Segment

| Vehicle Segment | Typical DV Loss Range (2026) | Market Sensitivity |

|---|---|---|

| Compact / Economy Cars | 6% – 10% | Moderate |

| Mid-Size Sedans | 8% – 14% | Moderate |

| Luxury Sedans | 15% – 25% | High |

| Premium SUVs | 12% – 22% | High |

| Pickup Trucks (High Trim) | 10% – 18% | Medium-High |

| Electric Vehicles (EVs) | 18% – 30% | Very High |

These percentages reflect real market behavior, not insurance formulas.

Why EVs Show the Highest Diminished Value Loss

Electric vehicles continue to lead all segments in diminished value impact.

Buyers remain cautious about battery health, long-term repair reliability, and post-collision performance. Even when repairs are completed correctly, accident history introduces uncertainty that directly affects resale pricing.

This is why EVs often show nearly double the diminished value percentage of comparable gas vehicles.

AE explains this market behavior clearly in how accident history affects vehicle value after a crash.

Luxury Vehicles: High Expectations, Higher Penalties

Luxury sedans and premium SUVs experience sharper post-accident discounts because buyer expectations are different.

In this segment, clean history is assumed. Once that assumption is broken, resale demand drops quickly. Dealers and private buyers both apply heavier discounts to offset perceived risk.

This aligns closely with what AE documents in stigma damage and diminished value explained.

Trucks and Economy Vehicles: Still Impacted, but Differently

Pickup trucks and economy vehicles tend to fall in the middle.

While these segments often retain value better overall, accident history still affects trade-in offers and private sale pricing. High-trim trucks, in particular, experience stronger diminished value losses because buyers paying premium prices expect clean records.

How These Numbers Are Used in Real Claims

Insurance companies often argue that diminished value is “minimal” or “speculative.” Market data tells a different story.

When vehicle segments are compared side by side, the pattern is clear:

accident history creates predictable, measurable resale loss.

This is why independent appraisals rely on segment-specific market behavior rather than generic formulas. AE outlines this process in how to document diminished value correctly for insurance claims.

For broader market context, Black Book continues to track these trends in current used car depreciation trends in 2026.

What This Means for Vehicle Owners in 2026

If your vehicle falls into a high-impact segment such as EVs, luxury sedans, or premium SUVs, your diminished value loss may be far greater than what insurers initially suggest.

Understanding how your vehicle category behaves in the market is the first step toward recovering a fair settlement.

Diminished value is not theoretical. It is visible every day in dealer offers, private sale listings, and market pricing.

Final Takeaway: The Market Sets the Value, Not the Repair

In 2026, diminished value is becoming easier to prove because the market is less forgiving.

As depreciation normalizes, accident history stands out more clearly, and certain vehicle segments are hit harder than ever. Data-driven analysis is now essential for accurate diminished value claims.

Independent documentation remains the most effective way to align insurance settlements with real-world market loss.