When your car is damaged in an accident, even the best repairs can’t restore its original market value. This loss, known as diminished value, can mean thousands of dollars in reduced resale or trade-in worth. Insurance companies won’t just take your word for it — they need proof. In this guide, you’ll learn exactly how to document diminished value after your vehicle has been repaired, what evidence matters most, and how to present it for the strongest possible claim.

By the end, you’ll know the step-by-step process to gather credible records, avoid common mistakes, and give yourself the best shot at recovering the full amount you’re owed.

Understanding Diminished Value and Why It Matters

Diminished value is the difference between what your car was worth before an accident and what it’s worth after repairs. Even if repairs are done perfectly, a documented accident history lowers a vehicle’s market value — buyers will pay less, and dealers will offer less in trade-in.

There are three main types:

- Inherent diminished value – The loss purely because of the accident history, even with perfect repairs.

- Repair-related diminished value – Loss due to subpar repairs or visible flaws.

- Immediate diminished value – The reduced value right after the accident but before repairs.

Documenting this drop in value is critical if you want an insurer — or a court — to take your claim seriously.

Why Proper Documentation Is Critical

Without organized, credible evidence, diminished value claims are often denied or underpaid. Documentation:

- Strengthens your negotiation position with insurers.

- Provides legal leverage if your claim goes to court.

- Closes gaps insurers might exploit to reduce or reject your payout.

Poor documentation leaves room for the insurer to question your numbers, claim your evidence is incomplete, or argue the loss is minimal.

The Key Documents You Need

When documenting diminished value, focus on gathering records that are objective and verifiable:

- Pre-accident value reports – Dealer appraisals, online value tools (Kelley Blue Book, NADA), or market comparisons.

- Repair estimates and invoices – Detailed breakdown of parts, labor, and costs.

- Photos before and after repairs – Show the condition and extent of damage.

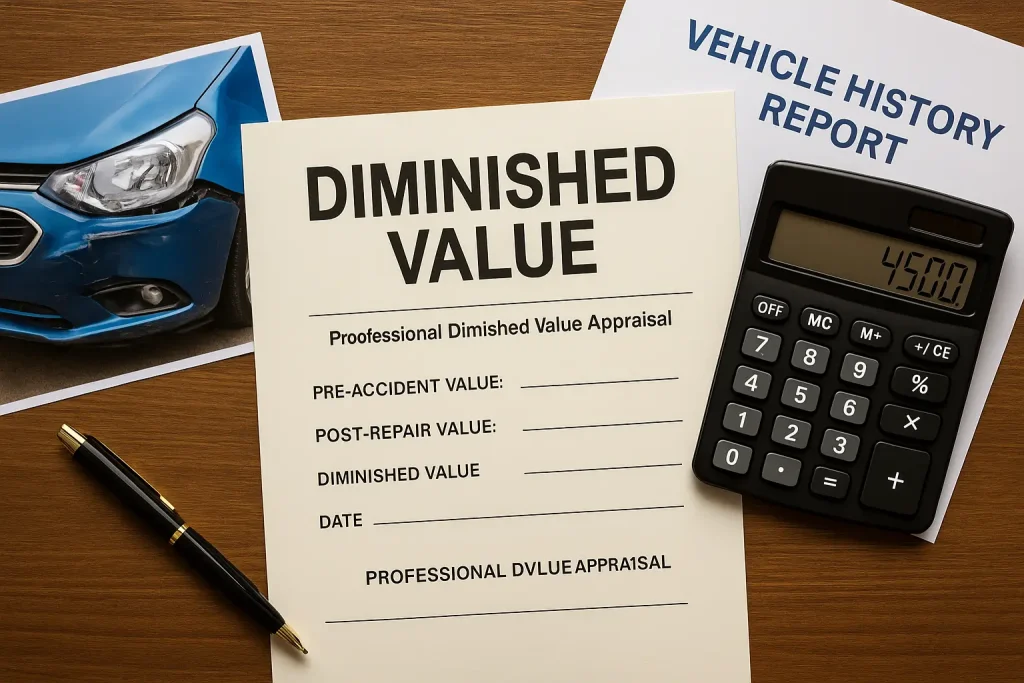

- Professional diminished value appraisal – A certified report calculating your post-repair value drop.

- Vehicle history reports – From services like Carfax or AutoCheck showing the accident entry.

Step-by-Step: How to Document Diminished Value

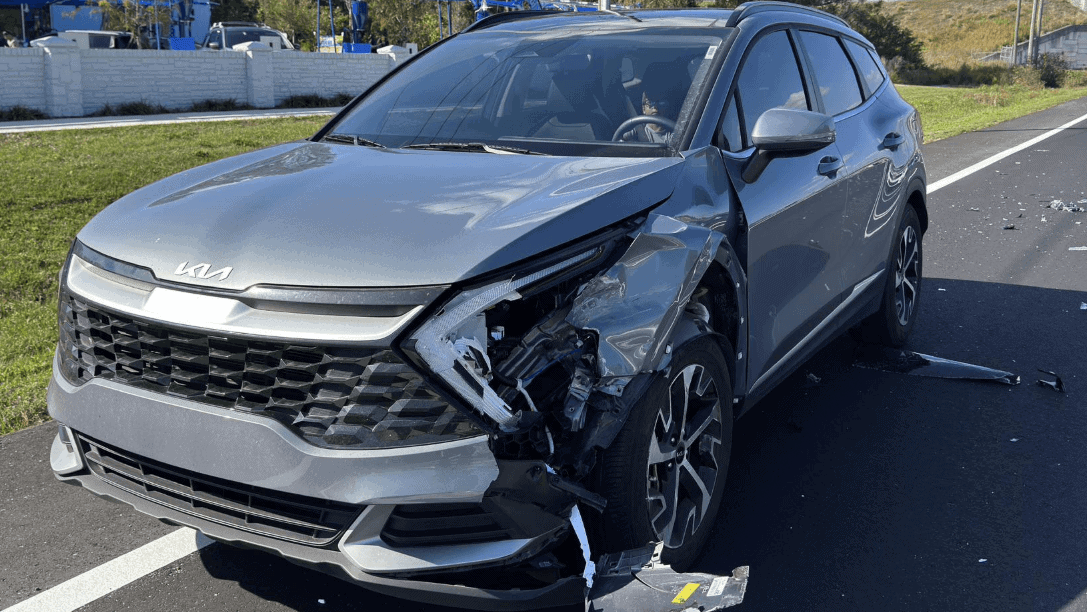

- Record the damage immediately

Take clear, date-stamped photos of the car from multiple angles before repairs start. - Keep all repair documentation

Save every invoice, parts list, and labor description — even minor items. - Get an independent diminished value appraisal

This should be from a qualified professional, not just the insurer’s preferred appraiser. - Compile market value comparisons

Show what similar undamaged cars are selling for in your area versus repaired ones. - Organize your evidence

Create a single, easy-to-follow file or PDF containing all photos, receipts, reports, and comparisons.

Presenting Your Case to the Insurance Company

When you submit your diminished value claim:

- Include all evidence together – disorganized submissions risk being ignored.

- Reference market data clearly – explain the value gap.

- Be ready for pushback – insurers often counter with low offers or deny diminished value entirely.

If you get an unfair response, you can request a written explanation, file an appeal, or consult an attorney.

How Documentation Helps in Legal Disputes

If your claim escalates to a lawsuit, your documentation becomes the foundation of your case.

- Attorneys rely on it to prove actual monetary loss.

- Judges and juries value objective evidence over personal estimates.

- Well-prepared files often encourage the insurer to settle before trial.

Final Tips to Maximize Your Claim

- Start documenting immediately after the accident.

- Use a professional appraiser with diminished value experience.

- Keep copies of everything in both digital and paper form.

Proper documentation can be the difference between a token settlement and fair compensation. The more thorough and credible your evidence, the harder it is for an insurer to deny your diminished value claim.