Paying for high deductible full coverage on an older car usually fails the math. With high deductible full coverage, the payout can be wiped out by the deductible.

Understanding Full Coverage and High Deductibles

“Full coverage” typically includes:

- Liability insurance: Covers damages you cause to others.

- Comprehensive insurance: Covers non-collision events like theft, fire, or weather.

- Collision insurance: Covers damage from an accident, regardless of who is at fault.

A deductible is the amount you pay out-of-pocket before your insurance kicks in. A high deductible (e.g., $1,000–$2,500) lowers your premium but increases your financial burden if you file a claim.

DOWNLOAD: “Full Coverage with a High Deductible on Low-Value Cars”.PDF

When Full Coverage with a High Deductible Fails the Math

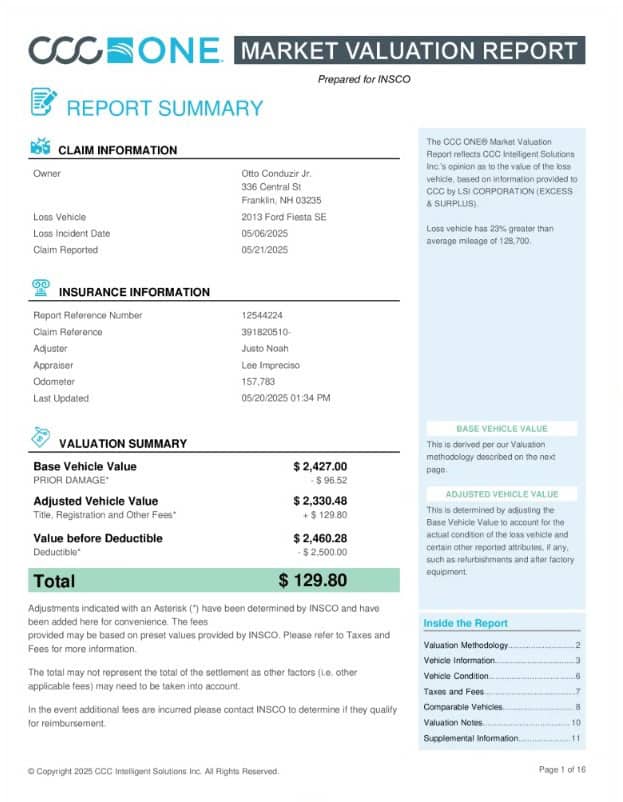

Let’s consider a real-world example from a recent valuation report for a 2013 Ford Fiesta SE with 157,783 miles.

The adjusted vehicle value was $2,330.48. Now consider the impact of a $2,500 deductible: the insurance payout would be effectively zero, meaning the policyholder would receive nothing beyond potentially some modest reimbursements for taxes or fees.

In this case, the payout before applying the deductible was $2,460.28. After subtracting the deductible, the net result was just $129.80—less than the cost of a towing bill.

Better Alternatives to High-Deductible Full Coverage

1. Premium Costs Often Exceed Potential Payouts

Even if you never file a claim, you’re still paying for coverage that may never return value. For a car worth less than $3,000, the annual cost of full coverage could easily approach or exceed 10–20% of the vehicle’s value.

2. High Deductibles Erase Most of the Value

If your deductible is higher than what your car is worth—or close to it—your insurer won’t pay out anything in the event of a loss.

3. You’re Essentially Self-Insuring

With a high deductible and a low-value car, you are effectively self-insuring against loss. You’re paying premiums for coverage you’ll likely never use.

4. Depreciation Undermines Your Coverage

Older cars depreciate rapidly, and so does the payout from insurance. What may seem like sufficient coverage today can become useless within months as your car loses value.

What to Do Instead (Liability-Only vs Full Coverage)

If your vehicle:

- Is worth less than your deductible

- Has high mileage and visible wear

- Is owned outright (not financed or leased)

- Would cost more to repair than replace

…then it’s time to consider dropping full coverage and switching to liability-only insurance. You’ll save money and avoid overpaying for protection that won’t realistically help you.

How Full Coverage Payouts Shrink Under a High Deductible

- Switch to liability-only coverage: This meets legal requirements and protects you from being financially responsible for damage you cause to others.

- Put the savings aside: Use the money you save on premiums to build an emergency fund or save for your next vehicle.

- Re-evaluate your insurance yearly: As your car ages and depreciates, so should your coverage.

Drop Full Coverage on Low-Value Cars and Save

Paying for full coverage with a high deductible on a low-value car is like buying a deluxe warranty for a toaster—it may give peace of mind, but it usually doesn’t make financial sense. If your car is barely worth more than the deductible, it’s better to focus on liability coverage and keep your money where it can truly make a difference.

Why Drivers Trust Us

✅ Patent-pending methodology for precise, efficient appraisals

✅ Specialists in diminished value and total loss claims

✅ Flexible options: in-person or desk appraisals

✅ Free Estimate to help maximize your payout

Every settlement decision is final — and costly if you choose wrong. Don’t let a rushed, lowball offer decide your future. Protect your payout, protect your peace of mind, and demand the fair value your vehicle truly deserves.

Request a free vehicle estimate today or look into the “Claim Settlement Offer: How to Spot Lowball Payouts”.