SUVs are beloved for their versatility, size, and family-friendly features. But after an accident, even if your SUV is repaired to perfection, it might lose value—a phenomenon known as diminished value (DV). For SUV owners, this can mean a substantial financial hit when it’s time to sell or trade in the vehicle.

So, why are SUVs particularly susceptible to diminished value, and how can you protect yourself? Let’s dive into the details.

DOWNLOAD: “SUV Accidents and Diminished Value: A Comprehensive Guide”.PDF

Why SUVs Are More Prone to Diminished Value

- Higher Purchase Prices, Bigger Losses

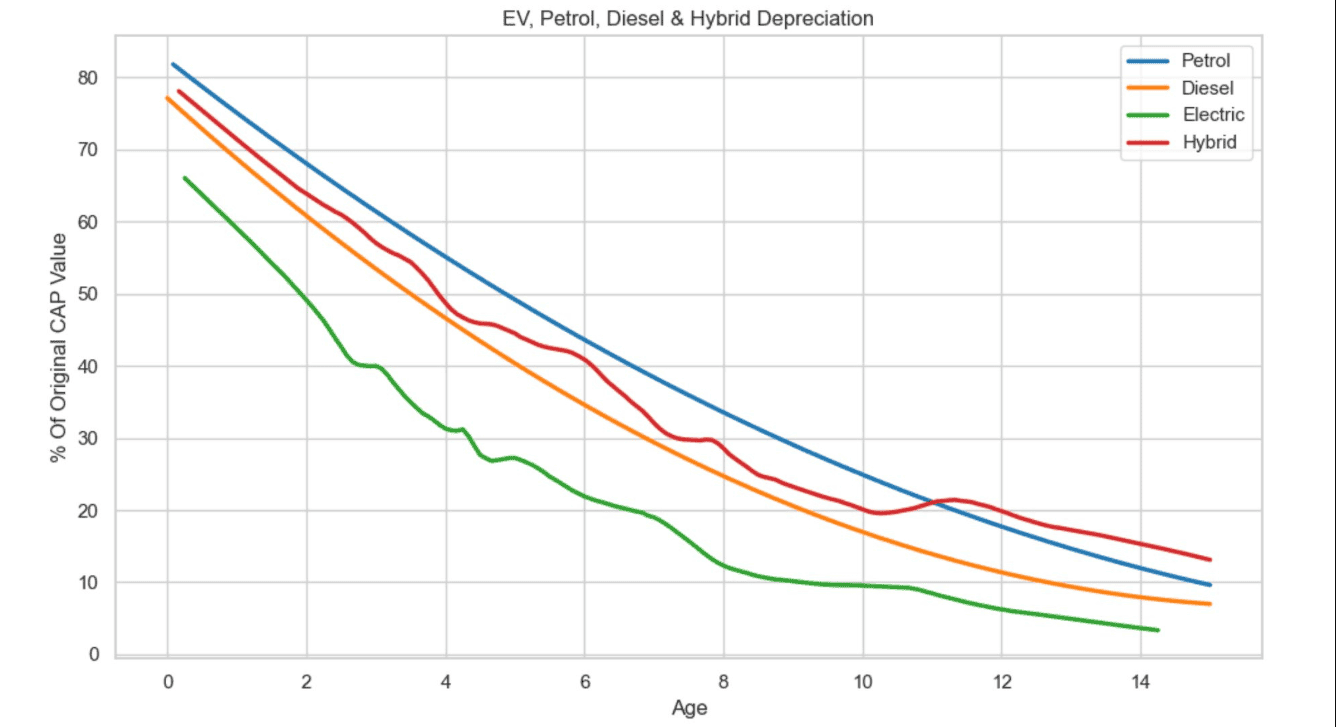

SUVs often come with higher price tags than sedans or compact cars. This means the post-accident value drop can translate to larger monetary losses. For example, a 10% loss in value on a $40,000 SUV is much more significant than on a $20,000 car. - Repair Costs Can Be Expensive

SUVs tend to require costlier repairs due to their size and features. If the repairs aren’t flawless, buyers may factor in additional future repair risks, leading to higher diminished value. - Market Perception and Safety Concerns

Buyers are often cautious about SUVs with accident histories, fearing structural issues or compromised safety features. Even if your SUV has been fully restored, the stigma of an accident can significantly lower its market appeal.

How Diminished Value Affects SUV Resale and Trade-In Value

Diminished value directly impacts the amount you can recover when selling or trading in your SUV. Here’s how:

- Private Sales: Buyers are likely to negotiate aggressively when they see an accident history on your SUV’s CARFAX report, even if the damage was minor.

- Dealership Trade-Ins: Dealers use accident history to justify lower trade-in offers, knowing they’ll face challenges reselling the vehicle.

- Leasing Penalties: If you lease your SUV and it’s involved in an accident, you may be charged for the diminished value when returning the vehicle.

How to Calculate Diminished Value for Your SUV

If you’re filing an insurance claim, understanding the diminished value calculation is crucial. Here’s a simplified process:

- Determine Pre-Accident Value (PAV)

Use tools like Kelley Blue Book to find the market value of your SUV before the accident. - Apply a Base Loss Percentage

Insurers often start with a baseline of 10% of the PAV. For example, if your SUV’s PAV was $30,000, the starting DV would be $3,000. - Adjust for Damage Severity

Multiply the base loss by a damage severity factor. For example:- Minor Damage: 0.25–0.50 multiplier

- Moderate Damage: 0.50–0.75 multiplier

- Severe Damage: 0.75–1.00 multiplier

- Account for Market Demand

Popular SUV models may experience less diminished value because of high demand, while older or less desirable models may take a larger hit.

Pro Tip: For a reliable estimate of your SUV’s diminished value, consider using Appraisal Engine’s Free Quote. Their team provides expert insights to help you understand your vehicle’s post-accident value, ensuring you’re well-prepared for claims or negotiations.

Tips to Minimize the Impact of Diminished Value

- Get an Independent Appraisal

Insurance companies may undervalue your diminished value claim. Hiring an independent appraiser ensures you have an accurate assessment of your SUV’s post-accident worth. - Document the Accident and Repairs

Keep detailed records, including repair invoices and photos, to demonstrate the quality of the repairs. - Negotiate with Your Insurer

Don’t accept the first offer. Use your appraisal and documentation to challenge lowball estimates from the insurance company. - Consult a Diminished Value Expert

Experts familiar with diminished value claims can guide you through the process and help maximize your payout.

Conclusion

SUVs are a significant investment, and accidents can cause a noticeable dent in their value, even after repairs. Understanding diminished value, how it’s calculated, and how to navigate insurance claims is essential for protecting your financial interests. Whether you’re planning to sell, trade, or keep your SUV, knowing its true value after an accident empowers you to make informed decisions.

Will you let diminished value affect your SUV’s worth, or take steps to claim what’s rightfully yours?

Frequently Asked Questions

Diminished value depends on factors like your SUV’s pre-accident value, damage severity, and market demand. On average, SUVs can lose 10% to 25% of their pre-accident value.

It depends on your policy and state laws. Many insurance companies don’t voluntarily offer diminished value coverage, so you may need to file a specific claim.

Not all states allow diminished value claims for SUVs or other vehicles. States like Georgia explicitly permit these claims, while others may impose restrictions or additional requirements. It’s crucial to review your state’s laws or consult a professional appraiser for guidance.

Yes, the age of an SUV significantly impacts its diminished value. Newer SUVs with higher market value typically experience more substantial depreciation after an accident compared to older models, which already have lower pre-accident values.