How to Use the Diminished Value Calculator

If your car has been in an accident, it has likely lost value—even after repairs. Insurance companies often undervalue this loss, leaving you with less than you deserve.

Our Diminished Value Calculator helps you estimate how much value your car has lost. Follow these simple steps to get started:

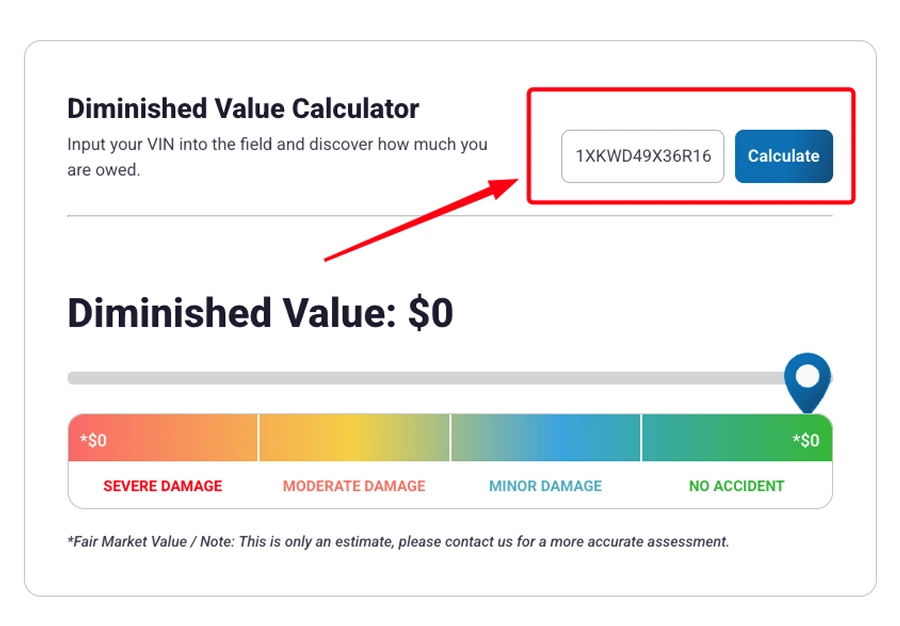

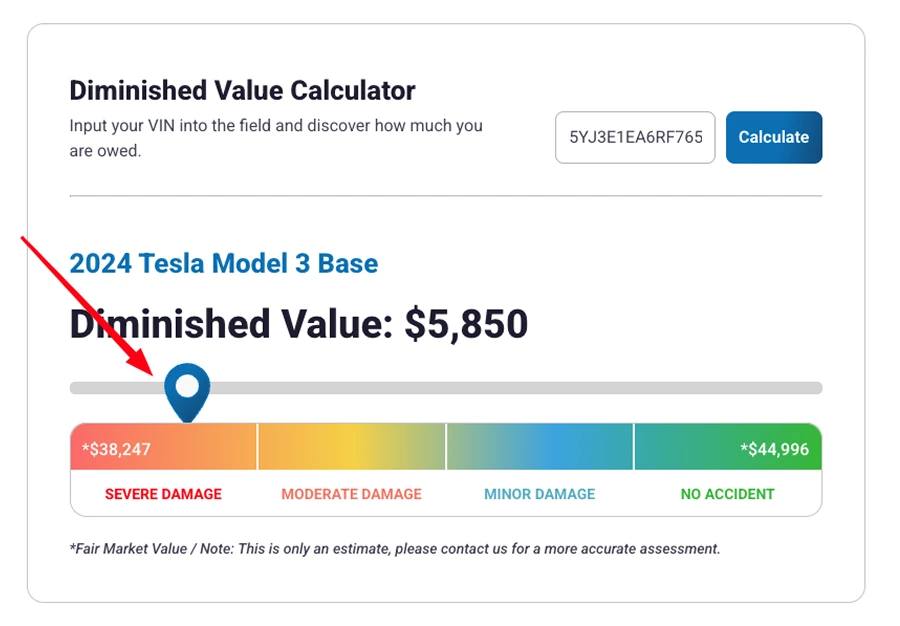

Step 1: Enter Your Vehicle Identification Number (VIN)

Your VIN is a unique code that identifies your car. It helps the calculator determine your car’s make, model, year, and market value before the accident

Where to find your VIN?

- Look at the driver’s side dashboard, near the windshield.

- Check your vehicle registration or insurance card.

- Open the driver’s side door and check the sticker on the frame.

Step 2: Adjust the Damage Severity Slider

Not all accidents cause the same level of damage. A minor fender-bender isn’t the same as a major collision.

Use the damage severity slider to select how bad the damage was. This helps refine your diminished value estimate.

Step 3: Get Your Instant Diminished Value Estimate

Once you input the VIN and adjust the damage slider, the calculator provides a rough estimate of how much value your car has lost.

Remember, this is not a professional estimate, and insurance companies will not take this into account. You can use this tool to get an idea of how much you can get.

Click here to connect with our team and get a FREE estimate from one of our expert appraisers—delivered within 24 hours.

How Diminished Value is Calculated

When your car is involved in an accident and is subsequently repaired, its market value drops—even if the repairs are flawless. This loss in value is called Diminished Value (DV).

Insurance companies often undervalue or ignore DV claims, which is why knowing how it’s calculated is essential. By the end of this section, you’ll understand:

- The three key factors that determine your car’s post-accident value

- Why some cars lose more value than others

- How insurance companies use these calculations to reduce payouts

The Three Core Factors That Determine Your Car’s Post-Accident Value

While most insurance companies rely on the flawed 17c formula, there is no universal method for calculating diminished value. However, professional real-world appraisals consider three key factors:

1. Pre-Accident Market Value of Your Car

Your car’s value before the crash is the starting point for any diminished value calculation.

- Higher-value vehicles lose more money in DV. A luxury car worth $50,000 will lose more in value than a $10,000 economy car.

- Market demand matters. A rare or high-demand vehicle may retain more value, while standard models depreciate faster.

How to find your pre-accident market value:

- Check pricing tools like Kelley Blue Book (KBB) or NADA Guides.

- Look at recent sales of similar cars in your area.

2. The Extent of the Damage and Repair Quality

Not all accidents cause the same level of diminished value. Even if your car looks perfect after repairs, buyers will still see it as “damaged goods.”

Factors that increase DV loss:

- Structural damage: Frame damage significantly lowers resale value.

- Airbag deployment: Indicates a severe accident, making the car harder to sell.

- Low-quality repairs: Cheap or unoriginal parts lower the vehicle’s worth.

3. The Vehicle’s Mileage and Usage

Mileage affects how much DV your car will suffer.

- Low-mileage cars lose more value because they are considered “newer” and more desirable.

- High-mileage cars already have depreciation, so their DV impact is lower.

Why the 17c Formula is Flawed for Diminished Value Calculations

The 17c formula traces its origins back to a 2001 court case, State Farm v. Mabry, which involved over 25,000 insurance claims in a class-action lawsuit. The court, faced with the logistical challenge of assessing so many claims, allowed the temporary use of a simplified calculation method. This was documented in paragraph 17, section “c” of the ruling—hence the name “17c formula.”

This formula was never intended as a universal standard, yet since 2001, insurance companies have clung to it, using it as a precedent to undervalue diminished value claims. The problem? The ruling was specific to the Mabry case and those 25,000 claimants—it was never meant to dictate how all future diminished value claims should be handled.

If you’re not part of that original lawsuit, the 17c formula shouldn’t apply to you. Insurers use it to minimize payouts, but that doesn’t mean you have to accept it. Know your rights, challenge flawed assessments, and demand a fair valuation of your vehicle’s true diminished value.

How the 17c Formula Calculates Diminished Value (and Why It’s Wrong)

Below is a step-by-step breakdown of how the 17c formula works, what each step calculates, and why it’s completely flawed.

Step 1: Base Loss in Value

The insurance company takes 10% of your car’s NADA retail value and calls it the “maximum” diminished value.

Example: If your car was worth $30,000 before the accident, the base loss is set at $3,000 (10% of $30,000).

Why This is Wrong:

❌ The 10% cap is arbitrary—it has no basis in market data.

❌ Some cars lose 20-30% or more, especially luxury vehicles or newer models.

❌ NADA retail values are meant for dealers, not consumers, making the calculation misleading.

Step 2: Mileage Modifier

Insurance companies apply a mileage multiplier, reducing the payout based on your car’s mileage.

| Mileage | Modifier Applied | Adjusted DV (from $3,000 base) |

|---|---|---|

| 0 miles | 1.00 | $3,000 |

| 20,000 miles | 0.80 | $2,400 |

| 50,000 miles | 0.50 | $1,500 |

| 80,000 miles | 0.30 | $900 |

| 100,000+ miles | 0.00 | $0 (No DV payout) |

Why This is Wrong:

❌ Mileage is already factored into NADA retail value, so this applies a double penalty.

❌ The formula assumes cars with 100,000+ miles lose no value, which is completely false.

❌ There’s no real-world data to support these numbers—they’re just arbitrary values chosen by insurers.

Step 3: Damage Severity Modifier

Insurance companies assign a damage multiplier based on the severity of the accident.

| Damage Level | Modifier Applied | Adjusted DV (from previous step) |

|---|---|---|

| Severe structural damage | 1.00 | No change |

| Moderate structural damage | 0.75 | 75% of previous amount |

| Minor structural damage | 0.50 | 50% of previous amount |

| Light body damage | 0.25 | 25% of previous amount |

| No structural damage | 0.00 | No DV payout |

Why This is Wrong:

❌ Ignores important damage types like flood damage, airbag deployment, and body repairs.

❌ Highly subjective—an insurance adjuster can manipulate the multiplier to reduce your payout.

❌ Many real-world DV cases exceed these capped values, making the formula completely unrealistic.

Many appraisers, attorneys, and industry experts reject 17C as an outdated and unfair method. Instead, real-world market data, expert appraisals, and resale trends should be used to determine true Diminished Value.

So, What is the Right Way to Calculate Diminished Value?

The best way to determine your vehicle’s true diminished value is by consulting a licensed and experienced car appraiser. The good news? Most professionals offer a free claim review to estimate your loss and how much compensation you’re owed.

⚠️ Beware of inflated quotes! Some appraisers exaggerate values just to sell reports—only for insurers to deny them. To get results, choose a company with a proven track record.

At Appraisal Engine, we’ve spent 20+ years fighting for fair settlements. Our patent-pending methodology is designed to counter lowball offers and ensure you get the compensation you deserve.

If you would like one of our appraisers to review your claim, please fill out the form below, and will get back to you with an accurate estimate within 24 hours.