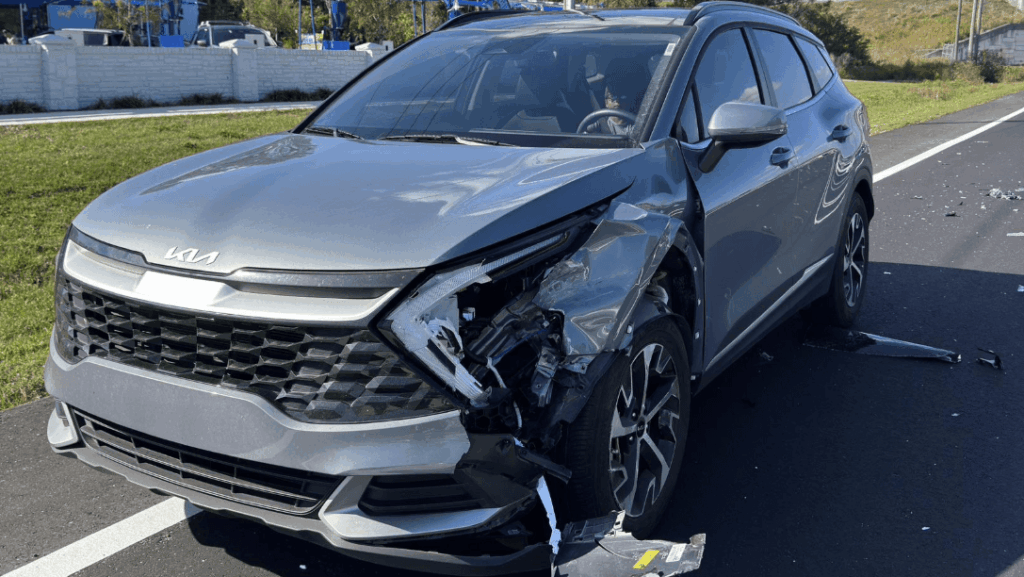

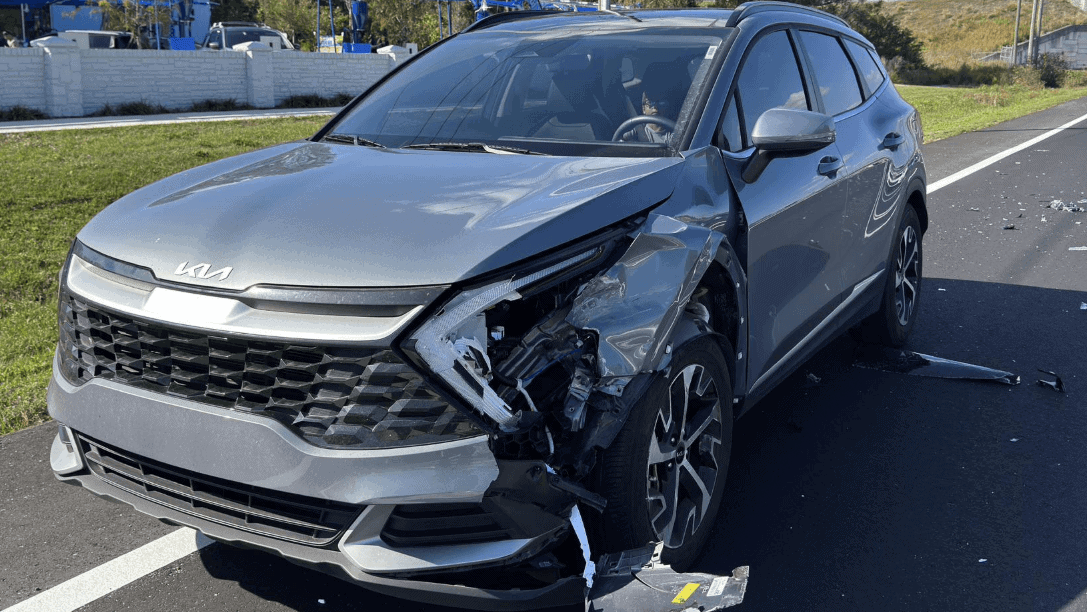

After a collision, most vehicle owners assume the repair estimate tells the full story. Once the bodywork is done and the paint dries, the problem feels “resolved.”

But in reality, the financial impact of an accident often goes far beyond what appears on a standard repair estimate.

At Appraisal Engine, we regularly review cases where the repair cost looks reasonable on paper, yet the vehicle has suffered a measurable loss that isn’t reflected anywhere in the estimate.

What a Standard Repair Estimate Is Designed to Do

Repair estimates are built for one primary purpose:

to identify visible damage and outline the cost to return the vehicle to a drivable and cosmetically acceptable condition.

They typically focus on:

Parts replacement

Labor hours

Paint and materials

Obvious structural or mechanical damage

What they do not account for is how the accident permanently changes the vehicle’s history, perception, and market value.

The Hidden Gaps Most Estimates Don’t Address

Even high-quality repair shops are not tasked with evaluating financial loss. As a result, several important factors are often overlooked:

Accident History and Market Stigma

Once a vehicle has an accident on record, buyers and dealers adjust expectations instantly.

This stigma exists regardless of how well the vehicle was repaired.

Reduced Trade-In and Resale Value

Dealers routinely deduct value for prior damage, even when repairs were completed correctly.

That deduction rarely appears in any repair paperwork.

Structural and Electronic Risk

Modern vehicles rely heavily on sensors, calibrations, and advanced driver-assistance systems.

Even when restored, these components can raise concerns for future buyers and appraisers.

Why Vehicle Owners Realize the Loss Too Late

Many drivers only discover the true financial impact months later—when:

Trading the vehicle in

Selling it privately

Filing a supplemental claim

Comparing similar vehicles without accident history

At that point, the repair estimate offers no leverage or explanation for the reduced value.

How a Professional Appraisal Fills the Gap

This is where an independent appraisal becomes critical.

A proper appraisal evaluates:

-

Pre-accident market value

-

Post-repair market perception

-

Comparable sales data

-

Accident severity and documentation

-

Long-term financial implications

Rather than focusing on repairs, it focuses on value.

Repair Cost vs. True Economic Loss

It’s common to see cases where:

Repair cost appears modest

Vehicle functions properly

Market value drops significantly

These situations are especially frequent with:

Late-model vehicles

Luxury or performance cars

Low-mileage vehicles

Vehicles with clean pre-accident history

Final Thoughts for Vehicle Owners

If you’ve been in a collision, don’t assume the repair estimate tells the whole story.

It answers one question—how much it costs to fix the car—but ignores another, often more important one:

How much value was lost because of the accident?

Understanding that difference can protect you financially long after the repairs are complete.

Suggested TAGS

Vehicle Appraisal

Collision Repair

Repair Estimates

Post-Accident Vehicle Value

Automotive Appraisal

Accident History Impact