In a surprising twist to the ongoing narrative of the auto industry, U.S. first-quarter auto sales have revved up by 5% despite the daunting high interest rates that have become a staple of our current economic landscape. Yet, as we shift gears to delve deeper, a fascinating subplot emerges: the growth of electric vehicles (EVs) is losing steam. This development unfolds against a backdrop of consumer apprehension towards EVs, stirred by concerns over limited range and the scarcity of charging stations. And in an intriguing turn of events highlighting consumer preference, the Chevy Trax, a model by General Motors, has raced ahead, outselling the entire Cadillac brand. Let’s buckle up and explore this journey, uncovering insights and trends that most discussions have left by the wayside.

Why Are Electric Vehicles Losing Steam? (PDF)

A Closer Look at the Numbers

In the first quarter of 2023, the U.S. auto market demonstrated resilience and adaptability, selling nearly 3.8 million vehicles, which translates to an annual rate of 15.4 million in sales. This performance is indicative of a sector that, despite economic headwinds, remains a cornerstone of consumer interest and investment.

Vehicle Sales and Market Dynamics

- Total vehicles sold: Nearly 3.8 million

- Annual sales rate: 15.4 million

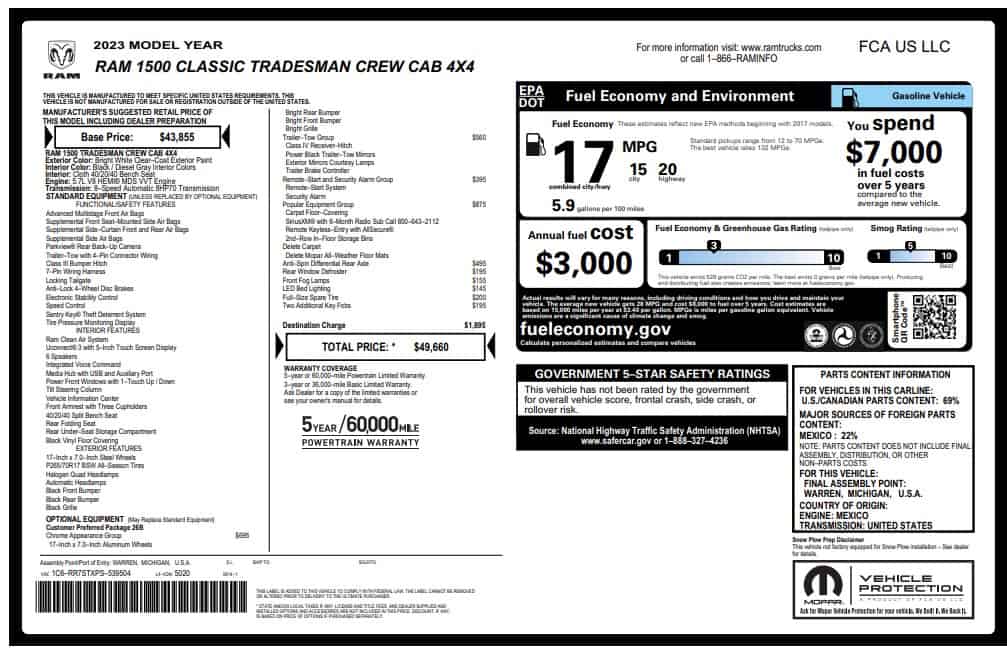

- Average sales price (March): $44,186

- Average discount (March): $2,800

Electric Vehicles: A Slowdown in the Fast Lane

Despite the overall market’s upbeat performance, EV sales growth slowed to just 2.7%, totaling over 268,000 vehicles for the quarter. This is a stark deceleration from the previous year’s 47% growth rate, raising eyebrows and questions about the future trajectory of the EV market.

EV Sales Overview

- Growth rate: 2.7%

- Total sales: Over 268,000

- Market share: 7.1%

The Undercurrents Shaping Consumer Choices

Economic Factors and Consumer Sentiment

High interest rates have cast a long shadow over the auto market, with the average automobile interest rate hovering around 7% per year. Yet, the market’s robust performance suggests a nuanced consumer behavior pattern, with expectations of rate cuts later in the year potentially influencing purchasing decisions.

The Small Vehicle Phenomenon

The adage “small sells” finds fresh relevance in today’s market dynamics. The Chevrolet Trax’s remarkable sales figures—37,588 units in the quarter—underscore a growing consumer preference for affordability and efficiency over luxury and size.

Industry Outlook and Challenges

As the industry navigates through economic uncertainties and evolving consumer preferences, the slowdown in EV growth poses both a challenge and an opportunity for automakers. Addressing concerns around charging infrastructure, battery life, and insurance costs will be pivotal in accelerating EV adoption among mainstream buyers.

Conclusion

The first quarter of the U.S. auto sales landscape presents a complex but intriguing picture of resilience, changing consumer preferences, and evolving market dynamics. While the overall growth is encouraging, the slowdown in EV sales signals a critical juncture for the industry, pushing it towards innovation and adaptation. As we move forward, the key to unlocking sustained growth lies in addressing the practical concerns of mainstream consumers and steering the market towards a future where both traditional and electric vehicles can thrive. The road ahead is filled with challenges, but also with opportunities for those ready to drive change.