USPAP Standard 8: Personal Property Appraisal Reporting (PDF)

In the field of personal property appraisal, it is essential for appraisers to effectively communicate their analyses, opinions, and conclusions in a manner that is clear, accurate, and non-misleading. This ensures that the intended users of the appraisal, such as clients, insurance companies, or legal entities, can properly understand the report. In this blog post, we will explore the standards and requirements outlined in the Uniform Standards of Professional Appraisal Practice (USPAP) for personal property appraisal reporting.

USPAP Standard 8 Personal Property Appraisal Full Document

Standard 8 Overview

Standard 8 focuses on the content and level of information required in a report that communicates the results of a personal property appraisal. It emphasizes that while USPAP does not prescribe a specific form, format, or style for appraisal reports, the substantive content of the report is of utmost importance.

General Reporting Requirements (Standards Rule 8-1)

Under this rule, each written or oral personal property appraisal report must fulfill the following requirements:

- Clarity and Accuracy: The report should clearly and accurately present the appraisal information, ensuring that it is not misleading.

- Sufficient Information: The report must contain enough information for the intended users to understand it properly.

- Disclosure of Assumptions and Conditions: All assumptions, extraordinary assumptions, hypothetical conditions, and limiting conditions used in the assignment must be clearly and accurately disclosed.

Content of an Appraisal Report (Standards Rule 8-2)

The appraisal report for personal property should be prepared using either the Appraisal Report or Restricted Appraisal Report option, clearly indicated at the beginning of the report. While additional labels may be included, they should not be used as substitutes for the standard labels.

An Appraisal Report should include, at a minimum:

- Identification: In the appraisal report, it is crucial to provide accurate identification of the client and any other intended user(s), specifying their names or types. Additionally, the intended use of the appraisal should be clearly stated to ensure proper understanding and context.

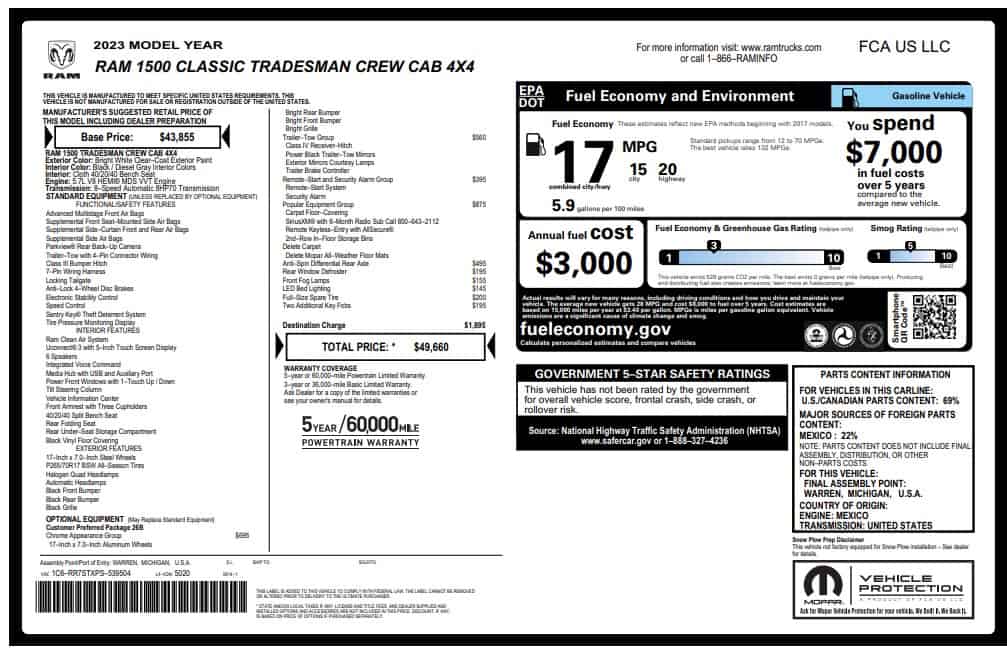

- Property Information: Sufficient information should be provided to identify the appraised property, including its physical and economic characteristics relevant to the assignment. The property interest being appraised should be stated.

- Type and Definition of Value: In order to ensure a thorough appraisal report, it is imperative to precisely outline the type and definition of value being employed, while referencing the authoritative source of the definition. Additionally, if the valuation opinion is influenced by non-market financing or financing arrangements with atypical terms or incentives, it is vital to provide a succinct summary of these financing terms and elucidate any potential effects on the final determined value.

- Effective Date and Report Date: The effective date of the appraisal and the date of the report should be stated.

- Scope of Work: Within the appraisal report, it is crucial to provide a concise summary of the scope of work undertaken to formulate the appraisal, encompassing the comprehensive research conducted and analyses performed. Furthermore, it is essential to disclose any substantial assistance received during the personal property appraisal process and to elucidate the specific roles played by each appraiser involved in the appraisal project.

- Compliance with Standard 7: The report should summarize the appraisal methods employed and state the reasons for excluding any approach(es) if they were not developed. It should also summarize the results of analyzing the subject property’s sales, agreements of sale, options, and listings if relevant to the assignment.

- Value Opinion and Conclusion: In the appraisal report, it is imperative to clearly articulate the value opinion(s) and conclusion(s) reached, accompanied by a comprehensive examination of the information analyzed and the underlying reasoning that substantiates them. Additionally, the report should incorporate the process of reconciling data and approaches employed to arrive at the final value opinion and conclusion.

- Use of the Property: As applicable, the report should state the current and alternative use of the property as of the effective date and as reflected in the appraisal.

- Opinion of Appropriate Market or Market Level: If developed, the opinion of the appropriate market or market level should be stated, along with its support and rationale.

- Extraordinary Assumptions and Hypothetical Conditions: The appraisal report should disclose all relevant assumptions, extraordinary assumptions, hypothetical conditions, and limiting conditions that were considered in the valuation. This helps ensure transparency and prevent misinterpretation of the appraisal results.

Standards Rule 8-3, Certification

A certification is a crucial part of an appraisal report and must be signed by the appraiser. It should address the following elements:

- Accuracy and Impartiality: The appraiser affirms the truthfulness of statements and the impartiality of analyses, opinions, and conclusions.

- Absence of Conflicts of Interest: The appraiser declares no personal or present interest in the subject property or the involved parties.

- Prior Services: The appraiser states they haven’t provided any services related to the subject property in the past three years.

- Impartiality and Bias: The appraiser confirms their lack of bias towards the subject property or parties involved.

- Non-Contingency: The appraiser asserts their independence from predetermined results and compensation based on specific outcomes.

- Compliance with Standards: The appraiser states adherence to the Uniform Standards of Professional Appraisal Practice (USPAP).

- Personal Inspection: The appraiser indicates whether they personally inspected the subject property.

- Personal Property Appraisal Assistance: The appraiser specifies if any significant assistance was provided and by whom.

The certification must be signed by any appraiser involved in the report. In cases of multiple specialties, each appraiser is responsible for their specific elements. The appraiser takes responsibility for relying on the work of others and must ensure their competence and credibility. The names of those providing assistance should be disclosed in the report.

Standards Rule 8-4, Oral Appraisal Report

An oral personal property appraisal report should, whenever possible and appropriate, cover the substantive matters outlined in Standards Rule 8-2(a). This includes identifying the client and intended user(s), providing an accurate property description, conducting a market analysis, incorporating comparable sales and listings, applying appropriate approaches to value, reconciling data and approaches, disclosing limiting conditions, and presenting a clear value opinion and conclusion. The appraiser should strive to address these essential aspects in the oral report, considering the feasibility and suitability of the specific assignment.

Personal property appraisal reports play a critical role in providing accurate and transparent valuation results. Including assumptions, hypothetical conditions, and limiting conditions ensures that the appraisal report communicates the analysis, opinions, and conclusions in a manner that is not misleading. By following the guidelines outlined in USPAP’s reporting standards, appraisers can uphold professionalism, build trust, and deliver high-quality appraisal reports to their clients and intended users.