Electric vehicles (EVs) have been a beacon of hope for a greener future, with rapid sales growth for nearly a decade. From 1% of total new car sales in 2016 to nearly 8% in 2023, the EV revolution has been accelerating at a breathtaking pace. But in the first half of 2024, something unexpected happened — EV market share dipped for the first time ever. Yes, sales hit record numbers, but the market share, the actual slice of the overall car pie, shrank.

So, what’s causing this unusual trend? And how can EV sales reach new heights while their market share falls? Let’s unravel the complexities of the 2024 EV market.

DOWNLOAD: “Record EV Sales in 2024 as Market Share Declines”.PDF

A Historic Moment: EV Market Share Shrinks

The EV industry has been steadily growing for years, but the first half of 2024 brought a change in direction. According to the Alliance for Automotive Innovation, purely electric vehicles accounted for a smaller percentage of the total U.S. market for the first time. Although the decline was slight—just 0.1%—it marked a significant shift in an industry that has only ever known growth.

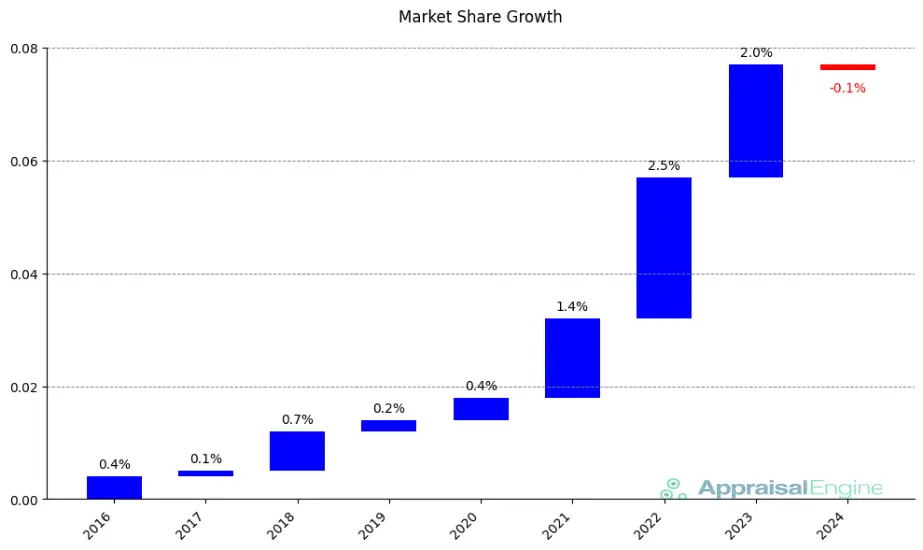

This shift in market share can be seen clearly in the graphic below, which shows the EV market share from 2016 to 2024. After steady growth, peaking at 2.0% in 2023, the market share dropped to 1.9% in 2024, marking the first-ever decline in this sector.

As the graphic illustrates, despite continuous year-on-year growth from 2016 to 2023, 2024 experienced a small but symbolic dip in EV market share. This 0.1% decline is a stark contrast to previous years of upward momentum, raising concerns about the future trajectory of electric vehicles in the broader auto market.

This dip has already led to real-world consequences. Lucid, one of the rising stars in the EV market, has begun trimming its U.S. workforce as a response to weakening demand. While this might seem alarming at first glance, it’s essential to look at the bigger picture.

Why Are EVs Losing Market Share?

Despite booming sales numbers, EVs are losing ground in market share due to a combination of factors. Let’s break it down.

- High Upfront Costs

EVs are still more expensive than traditional gasoline-powered vehicles, especially when you consider the premium prices of new models. While used EV prices are dropping, many buyers are still hesitant to make the financial leap into a brand-new electric vehicle. Cost-conscious consumers are keeping an eye on their wallets, especially in the current economic climate. - Political and Economic Uncertainty

The upcoming U.S. elections have injected a level of uncertainty into the EV market. Will government incentives and subsidies for electric vehicles continue? Will there be changes to environmental regulations? These unknowns are causing some consumers to hesitate, waiting for more stability before making their next big purchase. - Charging Infrastructure Concerns

One of the most significant barriers to wider EV adoption remains the availability of charging stations. Rapid-charging infrastructure is still lacking in many parts of the country, especially in rural areas. This shortage, combined with concerns about driving range, is giving potential EV buyers second thoughts. After all, no one wants to be stranded without a charge in the middle of a road trip.

These three issues are not just minor inconveniences—they’re legitimate roadblocks that are slowing the momentum of the EV movement, even as total sales climb.

EV Sales Hit Record Highs – But How?

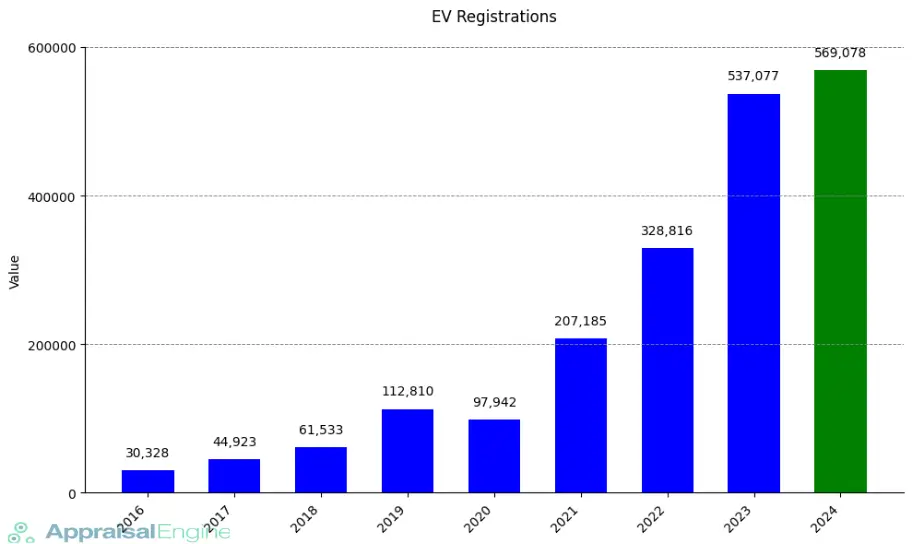

Here’s where things get interesting. Despite the slight drop in market share, EV sales continue to break records. In the first half of 2024 alone, around 569,078 electric vehicles were registered in the U.S., a 6% increase over the same period in 2023. The graphic below highlights this steady growth in EV registrations from 2016 through 2024.

As we can see, EV registrations have consistently risen year after year. The jump from 537,077 registrations in 2023 to 569,078 in 2024 reflects an ongoing demand for electric vehicles, despite the small market share decline.

So, how can sales be up, yet market share is down? The answer lies in the broader context of the auto industry. The overall market for vehicles has expanded, with more people buying cars in 2024 than in recent years. If the total market is growing faster than EV sales,

EVs end up occupying a smaller portion of that expanding pie. This is exactly what’s happening — the market is growing, but EVs aren’t growing fast enough to maintain their share.

EVs Remain a Bright Spot for Some Manufacturers

Not all manufacturers are feeling the pinch, though. Ford, for example, reported a 45% jump in EV sales through September 2024, with 68,000 EVs sold this year.

For Ford, the growth in EV sales nearly offsets the decline in traditional internal combustion engine (ICE) sales. The brand is adapting to changing consumer preferences by doubling down on electric offerings.

General Motors (GM) is telling a similar story. Despite a 2% overall sales decline in the third quarter, GM’s EV sales surged by 60% in the same period. GM’s executives are confident that their growing EV portfolio is what will drive future growth.

Both Ford and GM are examples of legacy automakers embracing the EV shift and seeing success, even as the market fluctuates. Newer brands like Lucid may face bigger challenges in a softening market, but the big players are still betting heavily on the future of electric vehicles.

Hybrids Are Making a Comeback

While fully electric vehicles may be hitting some bumps in the road, hybrid vehicles are experiencing a resurgence. For many consumers, hybrids offer a middle ground between the convenience of a gasoline engine and the environmental benefits of an electric drivetrain. They allow buyers to dip their toes into greener technology without the anxiety of finding charging stations or worrying about range.

In fact, hybrids are proving to be a major draw for drivers looking to make a greener choice without committing fully to an EV. As automakers expand their hybrid offerings, this segment of the market is seeing strong growth, particularly among buyers who are moving away from traditional ICE vehicles but aren’t quite ready to go all-electric.

What Does the Future Hold for EVs?

So, where does this leave us? Is the EV revolution slowing down, or are we just seeing a temporary speed bump on the road to full electrification?

While it’s true that the EV market share declined for the first time, it’s important to keep things in perspective. Sales are still growing, and manufacturers like Ford and GM are seeing strong demand for their electric offerings. Plus, as charging infrastructure improves and prices continue to fall, more consumers will likely make the switch to electric.

At the same time, the industry faces real challenges. From the high upfront costs to political uncertainty and charging infrastructure limitations, these obstacles will need to be addressed before we see the kind of widespread adoption that many EV advocates are hoping for.

Wrapping Up

The first half of 2024 gave us a mixed bag of results in the EV market. Record sales show that consumers are still interested in going electric, but the decline in market share suggests that there are real concerns holding people back. High costs, political uncertainty, and charging station shortages are all playing a role in slowing the momentum of EV adoption.

Will the industry overcome these challenges and get back on track for growth? Or will hybrids and traditional ICE vehicles continue to hold their ground in the years ahead? What do you think—are we still heading towards an all-electric future, or will the road be longer than expected?