Oversupply Expected to Trigger Significant Drop in New Car Prices (PDF)

In a matter of mere months, the pace of the U.S. automotive market has notably decelerated. Following a period of soaring average car prices just last summer, current projections by analysts indicate an impending price competition due to an oversupply of vehicles.

From Highs to Lows: Fluctuating Car Prices

A recent UBS report forecasts a 6% surplus in global car production compared to sales for this year, equating to an excess of 5 million vehicles that will necessitate price reductions to facilitate their sale, as reported by Yahoo Finance. While these price adjustments might not take effect until the latter part of 2023, automakers are gearing up for a potential price battle, with certain electric vehicle manufacturers already implementing price reductions.

UBS conveyed in a client communication, “Given the optimistic production schedules, the risk of overproduction and subsequent pricing pressures looms large. The price skirmish has initiated in the electric vehicle sector, and our anticipation is for it to extend to the internal combustion engine segment by the latter half of 2023.”

Analysts predict that manufacturers of family-oriented cars are likely to bear the brunt of these price cuts, whereas luxury automakers are projected to maintain relatively stable pricing.

Electric Vehicle Challenges

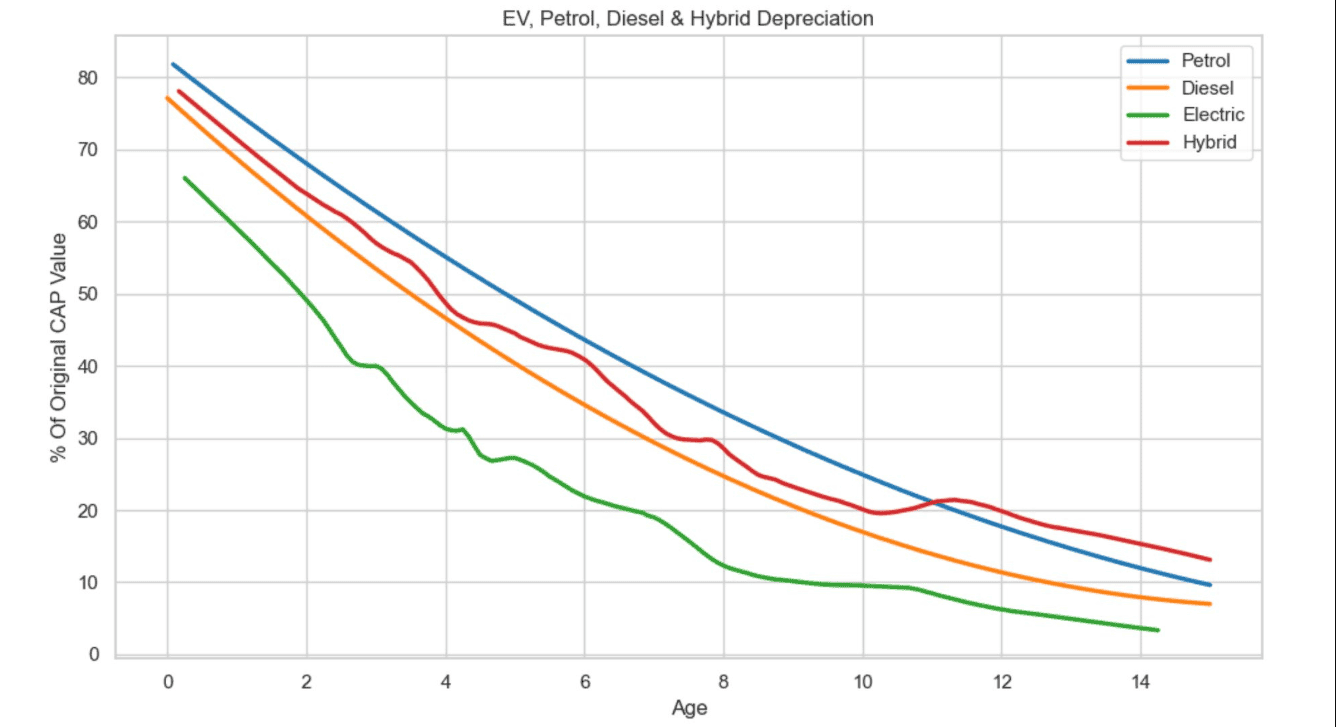

The electric vehicle sector could face significant setbacks due to escalating energy costs and elevated prices, resulting in limited affordability for many consumers. Elon Musk’s Tesla, for instance, reduced the cost of its vehicles by up to £8,000 in the U.K. in January. Consequently, some of its more economical models now fall within a similar price range as mass-market brands like Kia. Responding to Tesla’s adjustments, companies such as Ford Motor Company and Lucid have also decreased their electric vehicle prices, according to the Proactive Investors website.

Persistent Trend

Concurrently, there are early indicators of a softening trend in car prices across all segments. The most recent data from Cox Automotive, released on April 7, exhibited a 2.4% year-on-year decrease in wholesale used-vehicle prices for March, although there was a slight 1.5% month-on-month increase.

A report from Kelley Blue Book on March 23 revealed a three-month consecutive decline in new vehicle prices, suggesting the emergence of an enduring trend. Nonetheless, prices continue to stand at “historically high” levels.