Diminished Value Claims: What They Are and How to File Them (PDF)

When a vehicle is involved in an accident, even after it’s repaired, it may lose a portion of its market value due to the stigma associated with having been in a collision. This loss in value is known as “diminished value.” In this blog post, we’ll delve into what diminished value is, why it matters, and how to file a claim to seek compensation for the diminished value of your vehicle.

What is Diminished Value?

Diminished value refers to the reduction in a vehicle’s resale value after it has been involved in an accident and subsequently repaired. This reduction in value occurs because potential buyers are often wary of purchasing a vehicle with a history of accidents, regardless of how well it was repaired. There are three main types of diminished value:

- Immediate Diminished Value: This refers to the reduction in value right after the accident and repair. It takes into account factors such as the severity of the damage, the age of the vehicle, and its pre-accident condition.

- Inherent Diminished Value: This type of diminished value reflects the ongoing perception of the vehicle’s worth. Even if the vehicle has been repaired to its original condition, it will likely still be considered less valuable than an equivalent vehicle with no accident history.

- Repair-Related Diminished Value: This occurs when the repairs made to the vehicle are not up to the same standard as the original manufacturer’s specifications. In such cases, the vehicle’s value may be further reduced due to concerns about the quality of the repairs.

Why Does Diminished Value Matter?

Diminished value matters because it can have a significant financial impact on vehicle owners. If you decide to sell or trade in your vehicle, you may receive less money than you would have if the accident had never occurred. Diminished value claims aim to compensate vehicle owners for this loss in value.

How to File a Diminished Value Claim:

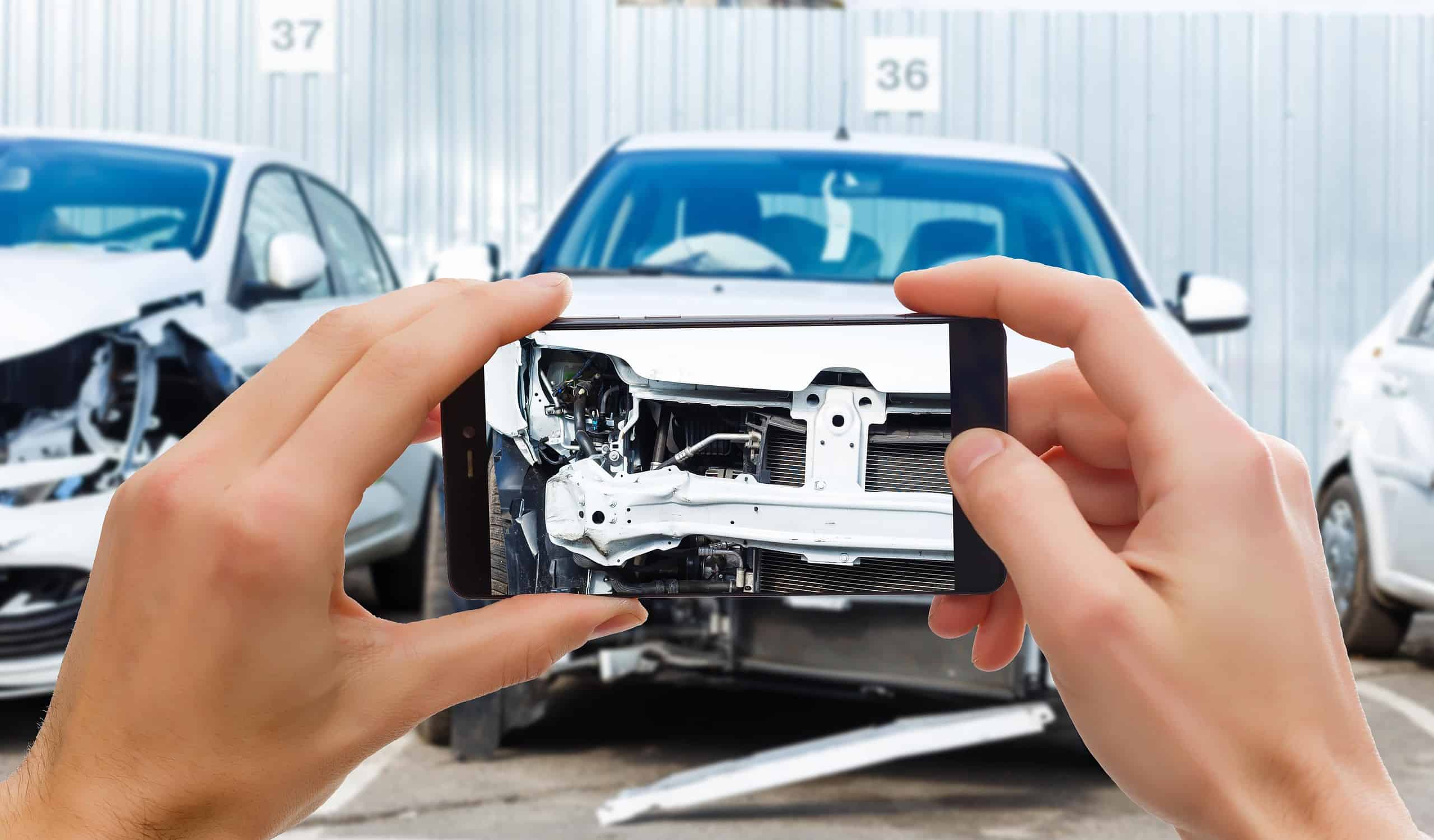

- Document the Accident: After the accident, make sure to document the details thoroughly. Take pictures of the damage, get copies of the police report, and collect any other relevant information.

- Obtain Repair Estimates: Obtain repair estimates from reputable auto repair shops. This will help establish the extent of the damage and the cost of repairs.

- Assess Diminished Value: To assess the diminished value, you can use various methods, including professional appraisals or online tools that provide estimates based on your vehicle’s make, model, age, and accident history.

- Notify the At-Fault Party’s Insurance: If the accident was caused by another driver, contact their insurance company to file a diminished value claim. Provide them with the documentation you’ve collected.

- Negotiate and Settle: The insurance company may offer a settlement for the diminished value. You have the right to negotiate this amount if you believe it does not adequately compensate you.

- Seek Legal Advice: If you encounter difficulties or disputes during the process, you might consider seeking legal advice to ensure your rights are protected.

Were You Recently Involved in a Car Crash?

No matter who was at fault, in Georgia you’re entitled to diminished value. Would you like to know how much your car lost due to a collision? Get a FREE Claim Review or call us now at (877) 677-2326 and get the money you deserve.

Licensed Auto Appraisers specializing in Diminished Value, Total Loss, Actual Cash Value, Classic Cars, and Insurance Claim Settlements. Don’t accept the insurance company’s offer before talking to us, we can often help you get more money!