Auto Inventory Surge: More Choices and Better Prices (PDF)

The US auto market is experiencing a gradual upward trend in new vehicle sales, despite the presence of growing inventories and falling prices. The immediate future of the industry remains uncertain, as it is unclear whether the increasing supply of vehicles or affordability concerns will shape consumer behavior. In this blog post, we will explore the current state of the US auto sales market and discuss the factors influencing its growth.

Steady Growth in May Sales

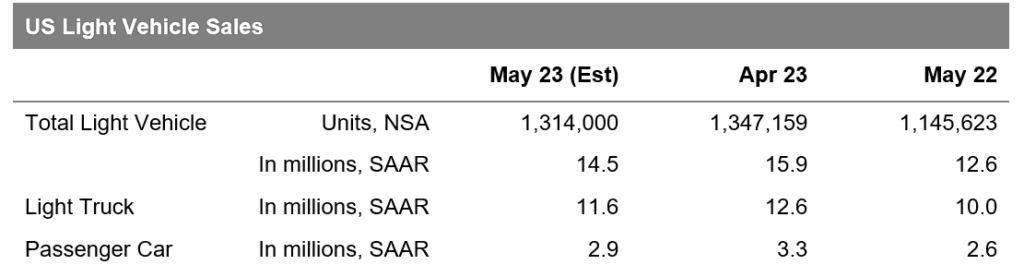

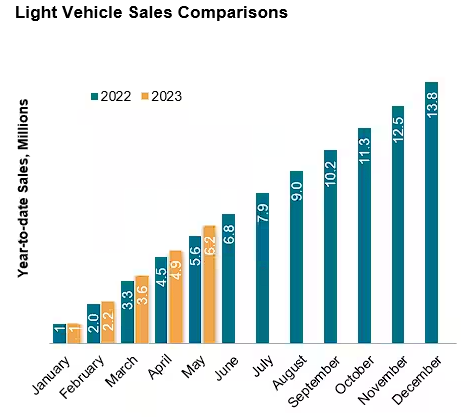

According to S&P Global Mobility, new light vehicle sales in May 2023 are projected to reach 1.31 million units, reflecting an 18% year-over-year increase. This marks the 10th consecutive month of improved sales volume compared to the previous year. While the estimated sales pace of 14.5 million units is slightly lower than the previous month, it aligns with the consistent monthly patterns observed in this metric.

Growing Inventories and Falling Prices

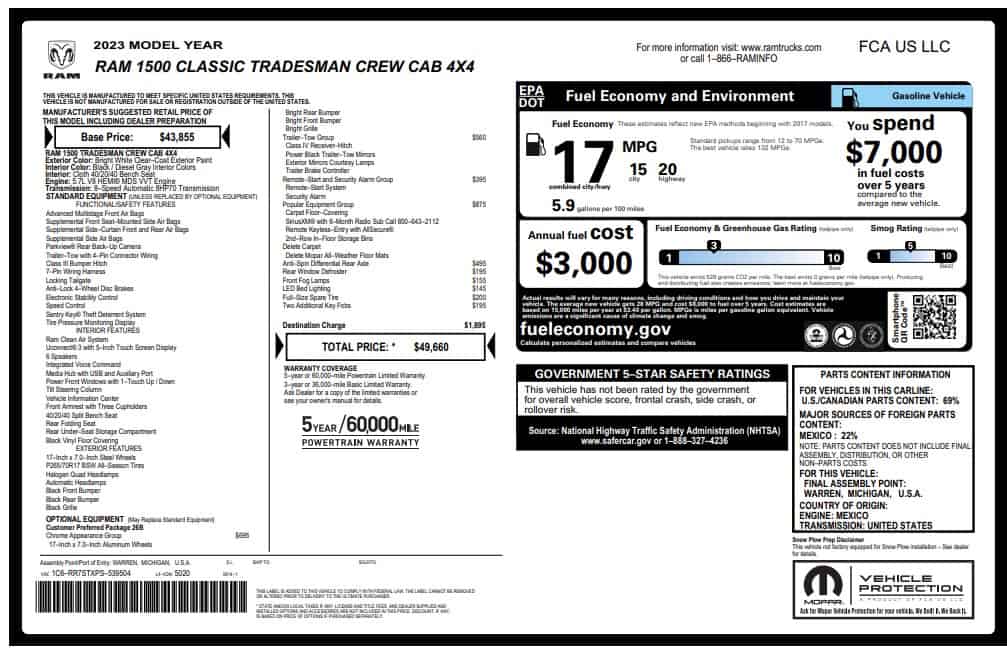

Supply chain challenges have gradually improved since the latter half of 2022, resulting in consistent growth in the number of vehicles available for sale. As we enter the summer season, the inventory of vehicles has stabilized at around 2 million units, indicating a substantial 67% surge compared to the previous year. This boost in supply has given consumers more leverage in negotiations, as 40% of vehicle listings now offer prices below the manufacturer’s suggested retail price (MSRP).

Opportunities for Savvy Consumers

Matt Trommer, associate director of Market Reporting at S&P Global Mobility, highlights the advantages for consumers in the current market. With the increased supply and greater negotiating power, consumers are better positioned to find deals on new vehicles compared to the pre-pandemic period. While certain models may still be challenging to find, the overall trend suggests that now is a favorable time for savvy buyers.

Uncertainty for the Future

Chris Hopson, principal analyst at S&P Global Mobility, points out the conflicting market conditions that are expected to affect auto sales in May. Although inventory levels are improving, consumer uncertainty remains a significant factor. The future of immediate term sales will be influenced by the progression of inventory levels and the economic headwinds that may arise in the second half of the year.

Factors Limiting Growth

While the analysis suggests that sales volumes in the coming months will remain consistent with the current trend, several factors could potentially restrict consumer choice. Affordability challenges arising from macroeconomic uncertainty, rising interest rates, and tighter credit conditions could counterbalance the benefits of increased inventory and downward pricing pressure.

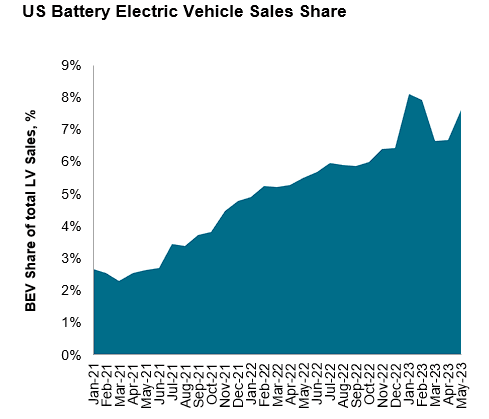

Continued Growth of Battery-Electric Vehicles

We also noticed the continued development and growth of battery-electric vehicles (BEVs) in 2023. BEV sales have increased by more than 45% through April 2023, representing approximately 110,000 additional units compared to the same period in 2022. However, the introduction of the US federal EV incentive eligibility and ongoing price adjustments from Tesla may introduce some volatility in the monthly BEV market share. Nonetheless, the projected BEV share of 7.6% in May indicates a sustained upward trend in their adoption throughout the year.