Picture this: your car is in an accident. The repairs are done, it looks like new, and it runs just fine. But then you try to sell or trade it in, and the offers are shockingly low. Why? Because diminished value has kicked in.

Diminished value is the hidden cost of an accident—the reduction in your car’s resale value simply because it has a collision history. Even when repaired to top condition, cars with accident records usually sell for less than those with a clean history.

In this article, we’ll explore how diminished value affects your car’s worth, the types of diminished value, and, importantly, how to make a diminished value claim to recover some of your losses.

DOWNLOAD: “Car’s Worth After the Crash”.PDF

What Is Diminished Value, and Why Does It Matter?

Diminished value is the drop in a vehicle’s market value after it’s been in an accident, even if it’s been fully repaired. Potential buyers tend to view accident history as a red flag, worrying about hidden issues or a reduced lifespan. As a result, vehicles with collision histories often fetch lower prices than similar models without accident records.

Why does diminished value matter? Because when it’s time to sell or trade in your vehicle, you might find that it’s worth significantly less than you expected. Insurance may cover repair costs, but it typically won’t cover the loss in market value. That’s where diminished value claims come in—they can help you recover some of the value lost due to the accident.

Types of Diminished Value: Important Insights Often Missed

Most articles cover the basics, but let’s dig a bit deeper into the three main types of diminished value and why each one matters:

- Inherent Diminished Value

This is the most common form of diminished value and the type most insurers acknowledge. Inherent diminished value refers to the loss in resale value that remains after the car has been fully repaired. Even if the repairs are flawless, the accident history itself is enough to lower the car’s market worth. It’s the “stigma” attached to the vehicle’s past, regardless of its current condition. - Immediate Diminished Value

This type of diminished value is the reduction in a car’s value right after an accident but before any repairs are made. While not directly relevant to resale value post-repair, immediate diminished value is often considered by insurance adjusters when determining the total loss of a vehicle. - Repair-Related Diminished Value

This type arises from incomplete or subpar repairs, which reduce the car’s value even further. Repair-related diminished value can stem from using lower-quality parts, visible paint mismatches, or alignment issues. If repairs weren’t done to factory standards, the car’s value suffers more than if it had been restored properly.

Understanding these types can be crucial when filing a diminished value claim because they help you frame your case. In most cases, you’ll be dealing with inherent diminished value when you claim compensation for the loss in resale value.

Why Diminished Value Isn’t Always Covered by Insurance

Here’s a little-known fact: not all insurance policies cover diminished value. Most policies cover the cost of repairs but stop there, leaving you to handle any depreciation in market value on your own. However, if the accident wasn’t your fault, you may be able to file a diminished value claim against the at-fault driver’s insurance.

Some states have laws that require insurance companies to compensate for diminished value, but others don’t. This inconsistency means it’s crucial to check your state’s laws and know your rights. In some cases, you may need to negotiate with the insurer or even hire an appraiser or attorney to help substantiate your claim. Don’t assume your insurer will automatically address diminished value—often, you have to advocate for it.

How to File a Diminished Value Claim

Filing a diminished value claim can be a bit more complex than a standard repair claim. Here’s a step-by-step guide to make sure you’re prepared:

- 1 – Gather Documentation

Start by collecting all records of the accident, including photos, repair bills, and any reports or documentation showing the extent of the damage. A full record helps substantiate that the vehicle has lost market value due to the accident. - 2 – Get a Diminished Value Appraisal

Many car owners overlook this step, but an independent appraisal can be critical. An appraiser specializes in assessing how much value your car has lost due to the accident and can provide a report that strengthens your claim. Some appraisers even offer diminished value assessments as part of their service. - 3 – Research Your State’s Diminished Value Laws

As mentioned earlier, diminished value claims are handled differently depending on where you live. Research your state’s laws or consult an attorney to understand what compensation you may be entitled to. - 4 – File the Claim with the At-Fault Insurer

If the accident wasn’t your fault, submit your claim to the at-fault driver’s insurance company. Include your appraisal report, documentation, and a detailed explanation of the diminished value. Be prepared for negotiation; insurers may try to lowball or deny these claims. - 5 – Consider Legal Assistance If Needed

If the insurance company resists, you may need to hire a professional to help you with the negotiation. Sometimes, the presence of a lawyer or appraiser can encourage a more favorable settlement.

How Much Value Does a Car Typically Lose After an Accident?

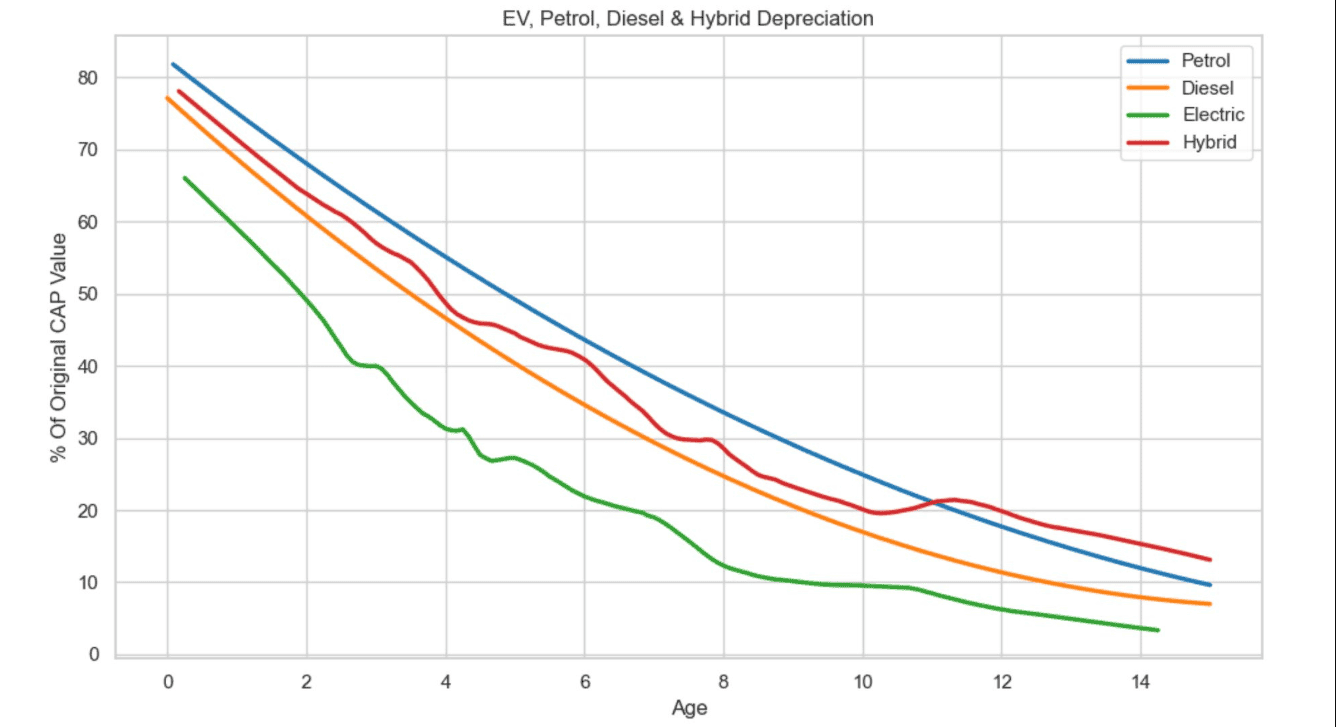

The exact amount your car loses in value depends on factors like the extent of the damage, the quality of repairs, and the car’s make, model, and age. Studies show that cars can lose anywhere from 10% to 25% of their pre-accident value due to diminished value, especially if the accident was severe.

For example, a newer model luxury vehicle could see a sharp drop in value, as buyers of high-end cars typically expect pristine condition and a clean history. On the other hand, a well-used, older car may lose less value, as potential buyers are less likely to mind prior damage.

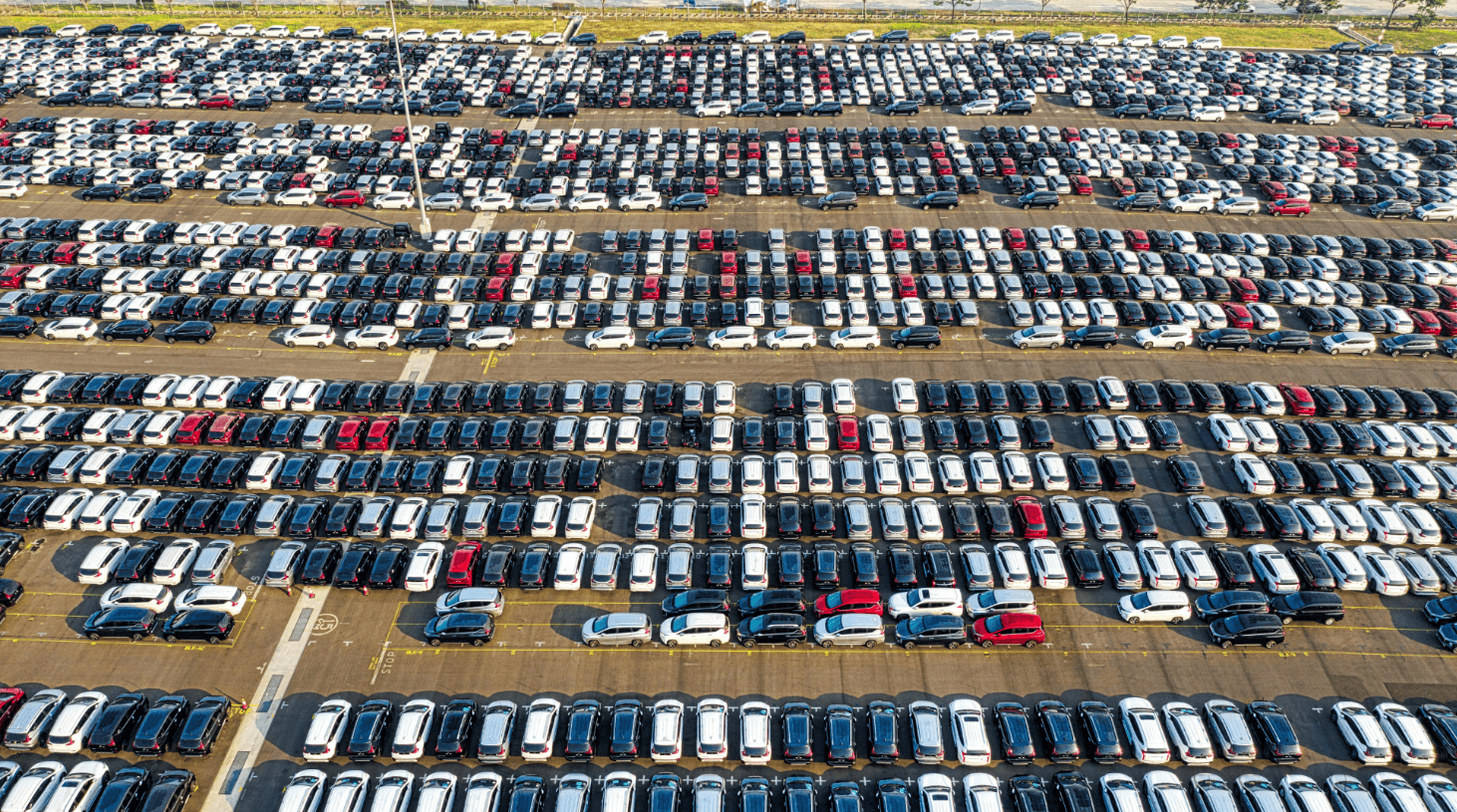

Why Diminished Value Matters When Selling or Trading In

When it’s time to sell or trade in your car, diminished value can make a significant difference in what you’re offered. Dealerships and private buyers alike have access to vehicle history reports through services like Carfax, which will show any accident history. Even if your car is in top shape, these reports signal to buyers that the vehicle has been in an accident, prompting lower offers.

Diminished value doesn’t just affect resale—it can also impact your trade-in value if you plan to upgrade your vehicle. Knowing how much value you’ve lost due to an accident can help you negotiate better or decide when it’s worth holding onto the car versus trading it in.

Conclusion

Diminished value is a hidden but very real cost of owning a vehicle post-accident. Even with the best repairs, a car’s market worth often drops simply because of its accident history. Understanding diminished value and knowing your rights to file a claim can help you recover some of that lost value.

So, if your car’s been in a collision, is it time to explore a diminished value claim? How much could your vehicle still be worth, even after an accident?