If you’ve been in an accident, you probably have questions about how insurance works when it comes to your vehicle’s value. This insurance claim FAQ covers the most important topics drivers face after a crash: total loss settlements, diminished value claims, and vehicle appraisals.

By the end, you’ll understand how each affects your payout and, therefore, what steps you can take to protect your rights.

Vehicle Appraisal / Valuation FAQ

When dealing with a car accident claim, the first step is often understanding the value of your vehicle. This part of our insurance claim FAQ explains what appraisals are, how experts perform them, and why they matter for your settlement.

Whether you’re negotiating with an insurer or preparing to file a diminished value claim, knowing how appraisals work gives you a stronger position.

1. What is a vehicle appraisal (valuation)?

An appraiser evaluates a vehicle’s worth at a given time (before damage, after repair, etc.) by comparing sales, mileage, condition, options, and history.

2. Why do I need an appraisal?

- To support or dispute the insurer’s value estimate

- To establish pre-loss value baseline (especially for diminished value)

- For negotiating settlements

- For legal or arbitration purposes

3. When should you schedule an appraisal?

- Before repairs (if you disagree with insurer’s value)

- After repairs

- Anytime there’s a dispute over value

4. What does a good appraisal include?

- Vehicle identification (VIN, make/model/year)

- Mileage, condition, options, history

- Photographs

- Market comparisons (comps)

- Adjustments for defects, upgrades, region

- Explanation of methodology

5. Can I use online valuation tools?

Yes, you can use them as part of your support evidence. However, such tools are general and don’t always reflect local market conditions, custom features, or damage history.

6. How do adjusters appraise the value?

Adjusters use a combination of market comparisons, pricing databases, local listings, and proprietary valuation software. In many jurisdictions, the insurer must justify how they calculated the figure.

7. Can I challenge the adjuster’s appraisal?

Yes — provide your own appraiser’s report, comparable sales, documentation, etc.

8. How much does an independent appraisal cost?

It varies by region and the complexity, but often several hundred dollars — but for higher value vehicles, the cost may be justified.

9. Does an appraisal consider “diminished value”?

Yes — in diminished value contexts, an appraisal might specifically compute pre-loss vs post-loss value to isolate the drop.

10. What happens if insurer refuses to accept my appraisal?

You may negotiate, appeal, escalate to arbitration or file with insurance regulator, or litigate (depending on your rights).

Diminished Value FAQ

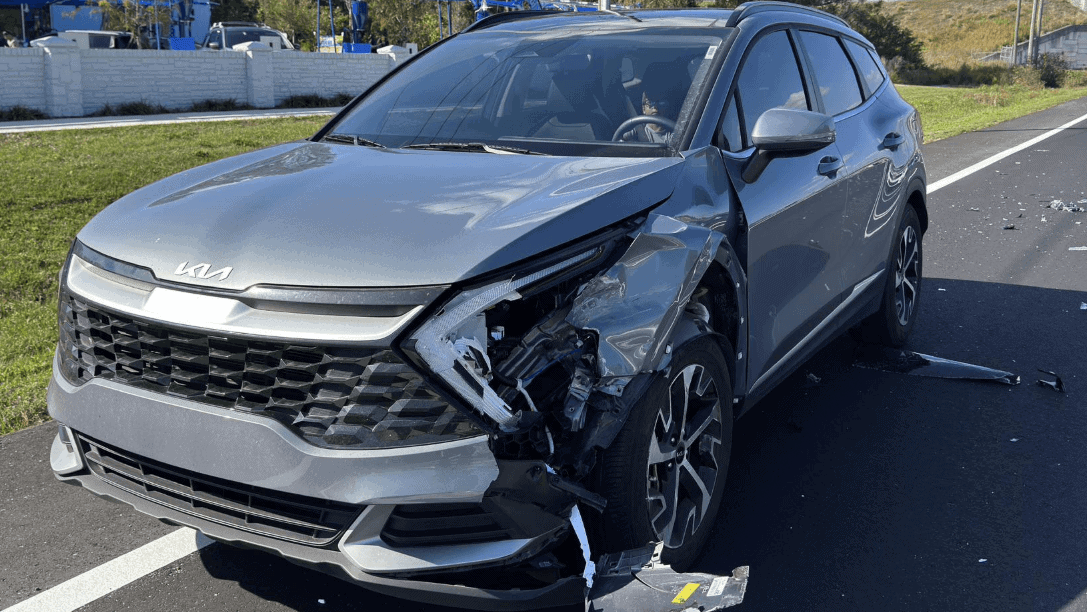

Once you repair your vehicle, its accident history still follows it. This section of the insurance claim FAQ focuses on diminished value — the reduction in your car’s resale or trade-in worth after an accident, even with quality repairs.

Here you’ll learn when and how you can file a claim, how insurers calculate diminished value, and why it’s worth pursuing in many cases.

1. How do we define diminished value?

A diminished value claim measures the difference between a vehicle’s value before an accident and its lower value after repairs, caused by accident history. Because no repair can duplicate the factory paint, also bent or damaged metal that is repaired is not the same as it was before the incident. And in extreme cases, collision repair shop welding is not done the same way as the factory did them.

2. What types of diminished value exist?

- Inherent diminished value: The loss in value due to accident history

- Repair-related diminished value: A vehicle loses additional value when repairs are substandard (like mismatched paint, structural issues).

- Immediate diminished value: Buyers see a drop in value immediately after the accident, before repairs are completed (rarely claimed).

- Insurance-related diminished value: Cases where insurer’s handling or decisions contribute to value loss (less commonly distinguished).

3. Who can file a diminished value claim?

Typically the non-fault party (i.e. the at-fault driver’s insurer). In many jurisdictions, your own insurer won’t pay diminished value in a first-party claim (when you’re at fault).

4. When should I file a diminished value claim?

After you complete repairs (so the true post-repair value is known). Don’t wait too long — statutes of limitation apply (varies by state).

5. How do insurers calculate diminished value?

Insurers use no universal formula, but a common approach in some states is the “17c formula” (first applied in Georgia litigation).

It involves:

- Finding pre-accident market value

- Applying a percentage cap

- Applying a damage multiplier (based on severity)

- Adjusting for mileage

That gives an estimate; insurers or appraisers may use more sophisticated market comparison methods.

6. Is diminished value claim always allowed?

No — it depends on state law and policy language. Some states allow third-party diminished value claims, while others restrict or prohibit them. A few states also allow rare first-party claims.

7. How much can be recovered?

It varies widely, based on:

- Pre-accident vehicle value

- Severity of damage

- Quality of repair

- Local market conditions

- Mileage & age

- Whether the vehicle is desirable

Most claims are modest, but for newer, premium cars, diminished value can be thousands.

8. Do I need an expert appraisal?

You can strengthen your case by hiring an independent appraiser, and their report helps you negotiate or resolve disputes more effectively. Contact us for a FREE Estimate!

9. What if the insurer denies my claim or undervalues it?

You can:

- Request written explanation

- Submit counter-offer with supporting data

- Hire your own appraiser

- Appeal to state insurance regulator

- Consider legal action (if justified)

10. Will filing a diminished value claim affect my insurance rates?

Usually not — because the claim is filed against the at-fault driver’s insurer, it doesn’t involve your own policy. However, check rules in your state.

11. Can I file diminished value if my car was totaled?

No — if your vehicle is declared a total loss, you don’t file a diminished value claim. You instead pursue a total loss settlement.

12. What’s the statute of limitations?

Varies by state. For example, it could be 1, 2, 3, or more years. Some states have special rules for diminished value claims.

13. What documentation will strengthen my claim?

- Pre-accident vehicle value comps

- Post-repair value appraisals

- Repair invoices & photos

- Vehicle history (Carfax, similar)

- Independent appraisal report

- Evidence of quality of repair and condition

14. Is diminished value worth pursuing?

Yes, especially for newer, low-mileage, or high-value vehicles. Even if your car looks brand-new post repair, its history can cost you in resale or trade-in value.

Total Loss FAQ

Not every damaged vehicle can be repaired cost-effectively. This section of the insurance claim FAQ explains what happens when your car is declared a total loss and how settlement is determined.

You’ll also see how to handle salvage options, title transfers, and rental coverage during the claim process.

1. What is a “total loss”?

Insurers consider a vehicle a total loss when repair costs are so high (including parts, labor, frame work, etc.) that it exceeds a certain threshold of the vehicle’s value, or when it cannot safely be restored.

Many insurers use state laws or internal thresholds to decide when repair is no longer practical.

2. How does the insurer determine the vehicle’s value (Actual Cash Value)?

They look at comparable vehicles in your local market—taking into account year, make, model, mileage, equipment, condition, and prior damage. The insurer normally gives you a valuation report or ‘settlement offer’ showing how they calculated the figure.

3. What happens after the adjuster declares the vehicle a total loss?

- The insurer presents you with a settlement offer.

- You must remove personal belongings (and sometimes license plates) and complete the title transfer paperwork.

- You must complete the title transfer paperwork.

- If there is a lienholder (you owe money on the loan), the lender will be involved.

- In addition, you may have to decide whether you want to retain salvage of the vehicle (if local law allows).

- The insurer picks up the vehicle (tow/salvage).

- You may be offered a rental (depending on your policy).

4. Will the vehicle be automatically removed from my insurance policy?

Not always. You need to notify your insurer and make changes. Until then, your coverage may remain active, which could generate unnecessary premium.

5. What if I still owe money on the vehicle?

The insurer will pay the lienholder up to the vehicle’s value (minus deductible). If your loan balance exceeds the settlement (a “negative equity” situation), you may have to cover the difference unless you have gap insurance.

6. Can I keep (“retain”) the salvaged vehicle?

In many jurisdictions, yes — but the insurer deducts your deductible directly from the settlement. Also, the car might then get a “salvage” or “rebuilt” title, which lowers its resale value and may affect insurability.

7. Can I get a rental vehicle during the total loss process?

If your policy includes Rental Reimbursement (or similar), yes — for a reasonable period until settlement is resolved. The adjuster should let you know how many days are covered.

8. How long does the total loss process take?

That depends on state laws, how quickly you provide needed paperwork (title, lien info, vehicle condition), whether there’s a dispute over value, etc. Many total-loss claims resolve within 1–3 weeks, but complex ones may take longer.

9. How can I speed up getting paid?

- Provide all requested documentation promptly (title, loan info, photos).

- Agree to electronic funds transfer (EFT).

- If you disagree with the offer, negotiate or provide supporting data (market comps, independent appraisals).

- Avoid unnecessary delays in title transfer.

10. Can I negotiate the insurer’s value estimate?

Yes. You can present your own evidence: comparable sales, appraisals, recent listings, condition photos, etc. If the insurer’s offer seems low, challenge it.

11. What is a “constructive total loss”?

Sometimes insurers declare a vehicle a total loss not because it’s irreparable, but because repair costs and related expenses exceed its value.

12. What happens to the title?

You’ll need to sign over the title to the insurer (if they take the vehicle). If you retain salvage, your state may rebrand the title as ‘salvage’ or ‘rebuilt

13. Will the insurer remove my deductible from the settlement?

Yes — the insurer will deduct your policy’s deductible from the settlement, unless some exception applies (varies by policy).

14. What about taxes, registration, other fees?

Depending on state rules, the DMV may refund your remaining registration fees or tax credits. But some states do not allow tax refunds for destroyed vehicles.

15. What if I disagree with the decision or offer?

- Request a re-inspection.

- Submit your own appraisal or independent expert report.

- Engage your state insurance regulatory body or file an appeal.

- As a last resort, you can file a lawsuit or seek arbitration if your policy or state allows it.

Conclusion

This insurance claim FAQ explains the three key areas: appraisals, diminished value, and total loss. As a result, by applying these guidelines, you prepare yourself to handle your settlement more effectively.

Why Drivers Trust Us

✅ Patent-pending methodology for precise, efficient appraisals

✅ Specialists in diminished value and total loss claims

✅ Flexible options: in-person or desk appraisals

✅ Free Estimate to help maximize your payout

Every settlement decision is final — and costly if you choose wrong. Don’t let a rushed, lowball offer decide your future. Protect your payout, protect your peace of mind, and demand the fair value your vehicle truly deserves.

Request a free vehicle estimate today or read our article “Claim Settlement Offer: How to Spot Lowball Payouts“.