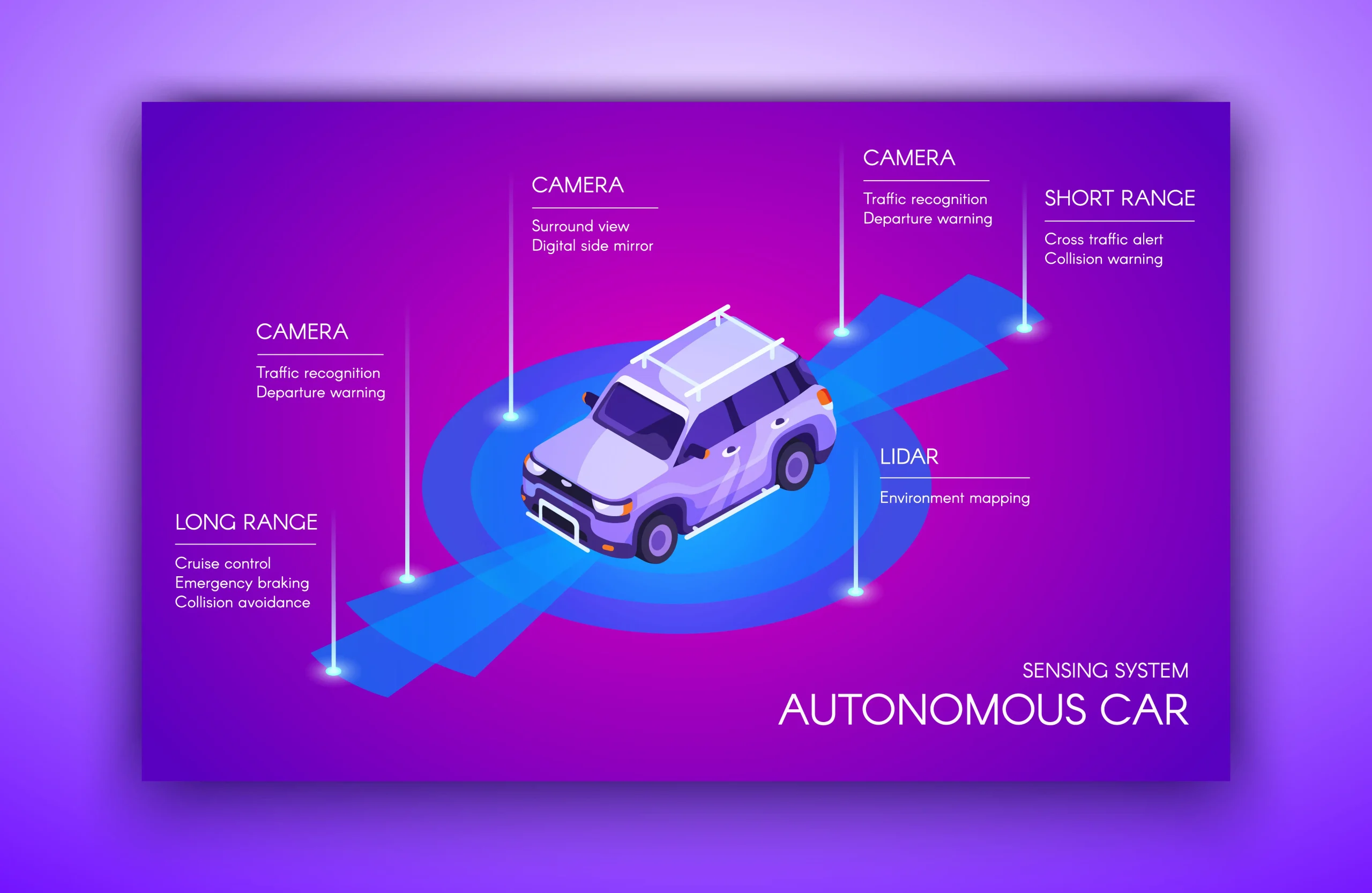

Autonomous vehicles (AVs) are revolutionizing the automotive industry, and they’re bringing seismic changes to auto insurance companies along with them. As technology giants like Waymo and Tesla lead the charge toward self-driving cars, traditional insurers are faced with a pressing question: How will these vehicles impact the way they do business?

In this article, we’ll explore the specific challenges and opportunities self-driving cars create for auto insurance companies, from liability shifts and cybersecurity risks to changes in regulatory standards and the rise of fleet insurance. Let’s dig into how these companies are adapting to the future of transportation.

DOWNLOAD: “Self-Driving Cars Impact Auto Insurance”.PDF

The Six Levels of Autonomous Vehicle Technology

To fully grasp how self-driving cars will impact auto insurance companies, it’s crucial to understand the six levels of vehicle automation defined by the Society of Automotive Engineers (SAE). These levels range from Level 0, where the driver has full control, to Level 5, where the vehicle operates entirely on its own without human input.

| Level | Description | Impact on Insurance Companies |

|---|---|---|

| 0 | No Automation: Human driver controls everything. | Companies rely on traditional models based on driver behavior. |

| 1 | Driver Assistance: Basic steering or speed help. | Minor risk reduction, slight adjustments to premiums. |

| 2 | Partial Automation: Car controls both steering and speed but needs attention. | Lower risk rates possible; slight impact on underwriting. |

| 3 | Conditional Automation: Car drives itself but requires driver backup. | Liability begins to shift towards manufacturers; insurers adapt policies. |

| 4 | High Automation: No human input needed in specific areas. | Major liability shift to manufacturers; insurers redefine their role. |

| 5 | Full Automation: Full self-driving capability in all conditions. | Complete transformation in policy models; focus on tech risks. |

This progression indicates that as self-driving technology advances, auto insurance companies will need to rethink their traditional business models, focusing more on technology risks than driver behavior.

Liability Shifts: A New Era for Insurance Companies

The primary challenge for auto insurance companies is the shifting landscape of liability. Traditionally, insurance policies have been designed around the concept of human error, which accounts for the majority of road accidents. However, with self-driving technology, this concept is evolving rapidly.

Experts like Melba Kurman emphasize that as AVs become more autonomous, liability will likely transfer from individual drivers to manufacturers and technology providers. For insurance companies, this means:

-

Increased Focus on Product Liability: Insurers might need to develop new policies that cover the potential faults in the vehicle’s AI or software rather than driver error.

-

Redefining Business Models: Companies will have to adjust their risk assessment strategies to account for technology-driven accidents and failures, rather than human-caused errors.

This liability shift could potentially reduce the market for traditional auto insurance policies, pushing companies to explore innovative coverage options that cater to the needs of autonomous technology.

Cybersecurity: The New Frontier for Insurance Risks

One of the most significant changes self-driving cars bring to the table is the increased risk of cybersecurity threats. For auto insurance companies, this opens up a new arena of risks that they’re not entirely accustomed to dealing with.

-

Cyber Insurance Policies: Insurers will need to develop policies that specifically address the risks of hacking and cyberattacks on autonomous vehicles.

-

AI and Software Vulnerabilities: Coverage will also need to expand to include issues like software malfunctions, GPS errors, and AI decision-making failures that could lead to accidents.

For insurance companies, adapting to these digital threats means transforming their traditional approach to risk management into one that prioritizes technology and data security.

Regulatory Challenges: Navigating a Complex Landscape

Auto insurance companies must also contend with the complicated regulatory landscape of autonomous vehicles. Currently, insurance laws differ from state to state, and these discrepancies make it difficult for insurers to develop standardized policies.

-

Push for Federal Standards: There’s a growing call for the federal government to establish nationwide guidelines for autonomous vehicles to create consistency in insurance requirements.

-

State vs. Federal Conflict: Auto insurance companies will need to be agile, navigating the balance between state regulations and potential federal standards to stay competitive.

Regulatory changes are inevitable as self-driving technology evolves, and insurance companies that can quickly adapt to these shifts will have a significant edge in the market.

Underwriting in the Age of Data-Driven Insurance

Underwriting is at the core of how insurance companies operate, and autonomous vehicles are poised to change this process drastically.

Traditionally, insurers have relied on data points like driving records and mileage to determine risk. With self-driving cars, this model needs to evolve.

-

Shift to Vehicle-Centric Data: Auto insurance companies will increasingly rely on telematics and real-time data from the vehicle itself rather than the driver’s history.

-

Dynamic Pricing Models: Premiums could be adjusted based on how well the vehicle’s technology performs, offering lower rates for those with advanced safety features.

This shift means that insurers must invest in technology that can track and analyze data from self-driving cars to provide more precise risk assessments and personalized pricing.

Rise of Fleet Insurance: New Opportunities for Insurers

As self-driving technology becomes more widespread, individual car ownership may decline, with consumers opting for shared AV services or ride-hailing options instead. This trend opens up new opportunities for auto insurance companies in the form of fleet insurance.

-

Fleet-Based Coverage: Insurance companies could see a rise in demand for policies that cover large fleets of autonomous vehicles rather than individual cars.

-

New Business Models: Companies like Waymo and Uber, which operate AV fleets, might seek out insurance partners who can offer specialized coverage for their entire vehicle operations.

The rise of fleet insurance offers a lucrative opportunity for insurers that can tailor their products to meet the specific needs of these large-scale operators.

Final Thoughts

The advent of self-driving cars is transforming the auto insurance industry at its core, challenging traditional business models and pushing companies to innovate.

From shifting liability and embracing cybersecurity risks to adapting regulatory changes and exploring fleet insurance, insurers must evolve to stay ahead in this new landscape.

The big question is: Will auto insurance companies be agile enough to navigate these changes, or will they struggle to keep pace with the rapid advancements in self-driving technology?