Imagine cruising down the highway only to find the road ahead is steeper and more expensive than ever before. For American drivers, this isn’t just a metaphor — it’s reality. Car insurance rates have rocketed to a 47-year high, a financial speed bump contributing significantly to the nation’s inflation woes. But fear not! This guide isn’t just about understanding why your wallet feels lighter; it’s about finding the exit ramp to more affordable coverage.

Why Car Insurance is More Expensive in 2024 and How to Save (PDF)

Why Are Rates Accelerating?

The Comeback of Traffic

Post-pandemic, roads are bustling again, and with more cars come more accidents, claims, and consequently, higher insurance costs. But there’s more under the hood of this price surge.

The Inflation Effect

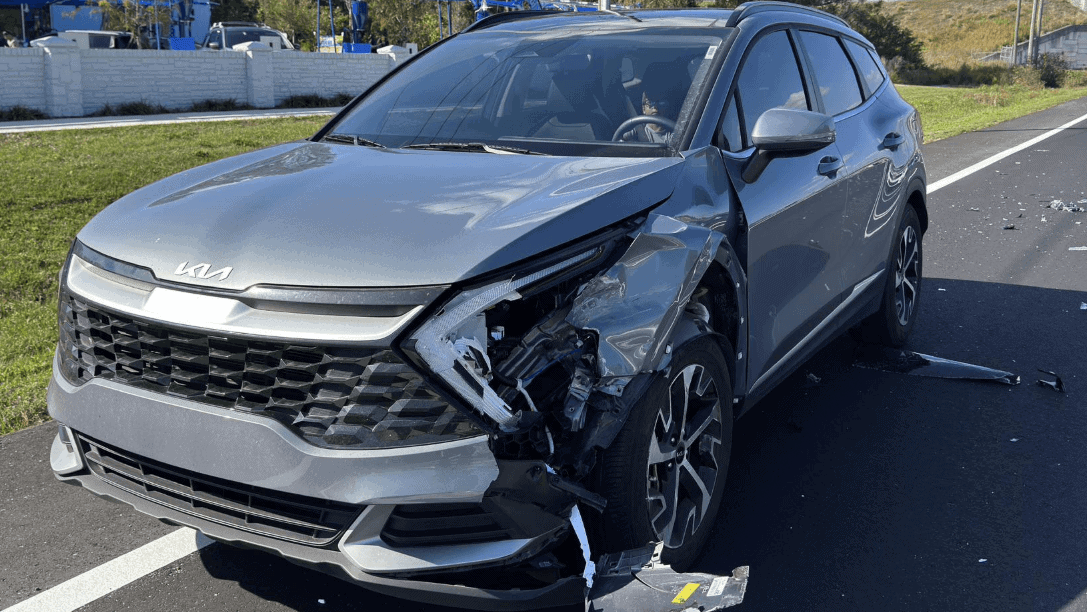

Inflation hasn’t just nudged up the price of your morning coffee; it’s also impacted the auto industry. From the showroom floor to the repair shop, costs are climbing. New, used, and rental cars, along with replacement parts, are all more expensive. Add to this the intricacies of repairing modern vehicles—think parking sensors and advanced batteries in electric vehicles—and the bill only gets heftier.

The Weather Wild Card

In 2023, the U.S. weathered (pun intended) a record number of costly natural disasters. Insurers, while unable to control the weather, have responded by being choosier about their policies and prices, especially in high-risk states.

Steering Out of the High-Cost Lane

Government’s Role

In response to this financial crunch, the Biden administration has urged big businesses to roll back prices inflated during supply chain disruptions. Additionally, independent agencies are tackling deceptive pricing practices. But for many, these measures feel like a drop in the ocean.

Taking Control

Why wait for policies to change when you can shift gears now? Shopping around for insurance can lead to significant savings, especially if your current policy’s cost is accelerating. Here’s how to get the best deal:

- Comparison Shop: Always get quotes from multiple insurers, especially if your policy’s price has jumped.

- Discounts and Deals: Clean driving records, loyalty bonuses, and bundled policies (like home and auto) can unlock lower rates.

- Know Your Vehicle: The type of car you drive matters. From eco-friendly hybrids to family SUVs, insurance costs vary.

| Key Factors Driving Up Insurance Costs | How They Affect You |

|---|---|

| Increased Traffic | More vehicles on the road lead to more accidents and claims, pushing up insurance costs. |

| Inflation | Rising costs for cars, parts, and repairs make insurance more expensive. |

| Advanced Vehicle Technology | High-tech features in modern cars, like sensors and electric vehicle batteries, are costly to repair. |

| Natural Disasters | An increase in severe weather events leads insurers to raise rates to manage their risk. |

| Strategies to Lower Your Insurance Costs | Details |

|---|---|

| Shop Around | Compare quotes from different insurers to find the best rate. |

| Discounts | Seek out discounts for clean driving records, loyalty, multi-car insurance, and bundled policies. |

| Vehicle Choice | The make and model of your car can significantly impact your insurance rates. Choose wisely based on insurance affordability. |

Conclusion

Navigating the current landscape of car insurance requires a blend of understanding, strategy, and action. While we can’t control market trends or weather patterns, we can take the wheel when it comes to our insurance choices. By staying informed, shopping smart, and capitalizing on available discounts, you can find a path to more affordable auto insurance, even in these financially turbulent times.

Remember, the road to savings is always open; it just might require a bit of maneuvering to get there!