Electric vehicle depreciation in 2026 continues to reflect a market that began adjusting sharply in 2025. What started as a correction phase has now become a measurable trend across resale data, auction activity, and insurance valuations.

If you own an electric vehicle, are considering selling, or are dealing with an insurance claim, understanding what is happening right now is critical. The EV market is maturing, and with that maturity comes pricing correction.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

How Much Value Are EVs Losing in 2026?

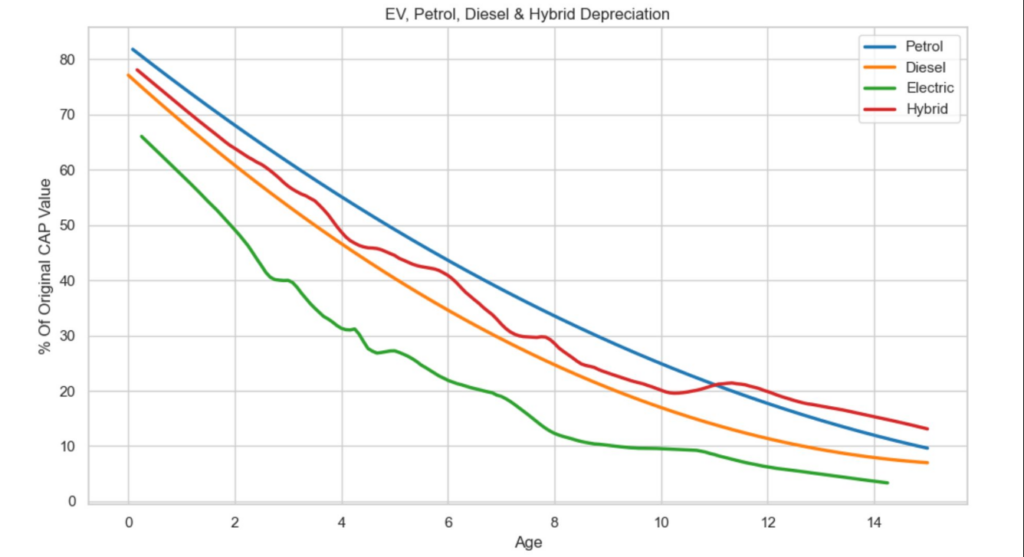

Depreciation has always been part of vehicle ownership. What makes 2026 different is the speed at which certain EV segments are losing value compared to traditional vehicles.

Recent market data shows a noticeable gap between electric and gas-powered models over a three- to five-year period:

| Vehicle Type | Avg. 3-Year Depreciation | 5-Year Depreciation Estimate |

|---|---|---|

| Electric Vehicles (EVs) | 45% – 55% | 55% – 65% |

| Luxury EVs | 50% – 60% | 60% – 70% |

| Gas-Powered Sedans | 30% – 40% | 45% – 55% |

| Hybrid Vehicles | 35% – 45% | 50% – 58% |

| Pickup Trucks (Gas) | 25% – 35% | 40% – 50% |

In practical terms, a $55,000 electric SUV could be worth between $27,000 and $30,000 after three years. Recent national resale reports confirm that electric vehicles are depreciating faster than many traditional segments. Some luxury EVs have experienced even steeper drops, particularly when new generations launch with longer range or updated technology at competitive pricing.

This does not mean every electric vehicle follows the same curve. Brand strength, battery range, demand, and regional incentives all influence outcomes. However, the broader trend is clear: electric vehicle depreciation in 2026 continues to outpace many traditional vehicles.

Rapid Technology Changes Are Compressing Resale Value

One major factor is how quickly EV technology evolves.

Battery range continues to improve year after year. Charging speeds are increasing. Software updates and driver assistance systems are advancing rapidly. When a new model launches with 40 or 50 additional miles of range at a similar price point, last year’s version immediately feels less competitive.

Gas-powered vehicles evolve more gradually. EVs move faster. That pace shortens perceived lifecycle value and accelerates depreciation.

On top of that, manufacturer price adjustments have had a direct impact. When automakers reduce MSRP to stay competitive, used vehicle values respond almost immediately. A $5,000 to $7,000 reduction in new pricing can erase thousands in resale value overnight.

Incentives Are Shifting Buyer Behavior

Government incentives also influence depreciation patterns.

Many buyers qualify for tax credits or rebates when purchasing new electric vehicles. Used EVs do not always benefit from the same level of financial support. When buyers compare a discounted new model with full warranty coverage against a used vehicle without incentives, demand naturally shifts toward the new option.

This dynamic places additional pressure on used EV pricing.

Battery Perception Still Affects Resale Prices

Even though real-world data shows that modern EV batteries are generally durable and backed by extended warranties, consumer perception still plays a role.

Buyers often worry about long-term degradation and replacement costs. While battery warranties commonly extend to 8 years or 100,000 miles, uncertainty still influences willingness to pay premium resale prices.

In traditional vehicles, consumers understand engine wear patterns. With electric vehicles, the learning curve is still ongoing. Market psychology continues to shape electric vehicle depreciation in 2026 just as much as hard performance data.

Supply Is Increasing in the Used Market

Another key factor is rising inventory.

Strong EV sales and leasing growth from previous years are now feeding more vehicles into the used market. As lease returns increase, supply expands. When supply grows faster than demand, pricing adjusts downward.

This is especially visible in compact electric SUVs and entry-level electric sedans, where inventory levels have risen noticeably compared to prior years.

Depreciation accelerates when market balance shifts.

What This Means for Appraisals and Insurance Claims

Electric vehicle depreciation in 2026 continues to have direct implications for valuation accuracy.

For total loss settlements, insurers must rely on current market data rather than older residual assumptions. Overestimating retained value can lead to disputes. Underestimating can negatively affect policyholders.

For diminished value claims, the situation becomes more complex. When a vehicle already experiences faster baseline depreciation, isolating accident-related loss from normal market decline requires precise data analysis.

Accurate appraisals depend on recognizing how quickly EV pricing is evolving.

Should EV Owners Be Concerned?

Faster depreciation does not automatically mean electric vehicles are a bad investment. EV ownership still offers potential savings in fuel, maintenance, and long-term operating costs.

However, resale timing matters more now than it did in previous years. Owners planning to sell may benefit from monitoring market trends and inventory levels. Those involved in insurance claims should ensure valuations reflect current market realities.

Electric vehicle depreciation in 2026 reflects an ongoing market transition that began with major pricing adjustments in 2025. As technology improvements stabilize and supply normalizes, depreciation curves may become more predictable. For now, informed decision-making is the key advantage.

Understanding how and why EV values are adjusting gives owners, appraisers, and insurers the clarity needed to navigate a rapidly evolving automotive landscape.

Download the PDF Version

Prefer to read or share this guide as a PDF? Download the full version below.