From rooftops to accident scenes, drones in appraisals are transforming inspections. What once took hours and exposed appraisers to risk now takes minutes with aerial footage and precise data.

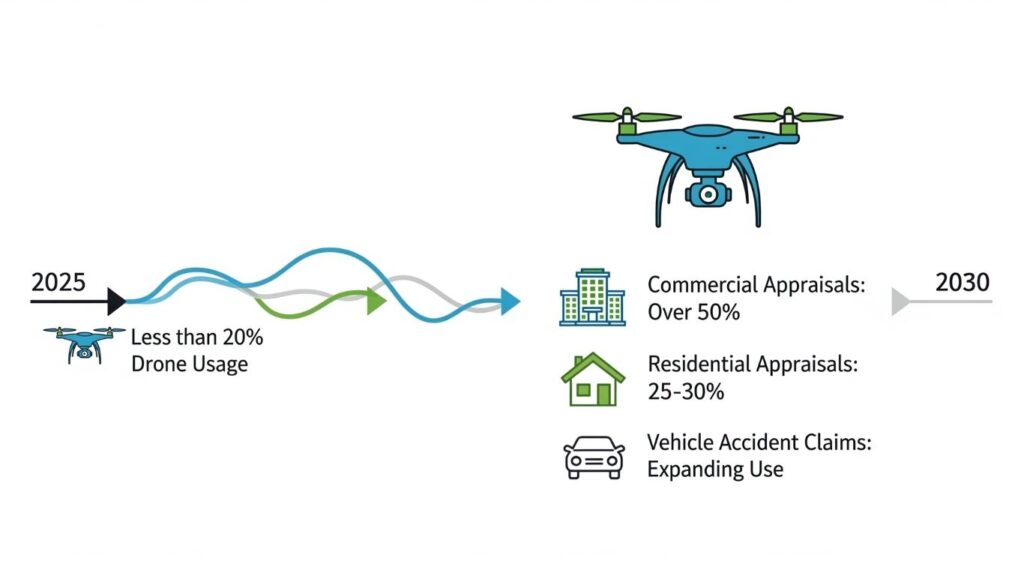

Although fewer than 20% of appraisals use drones today, their adoption is rising quickly. In this guide, you’ll learn how often drones are used, when they matter most, their benefits and challenges, and why they’re becoming a critical tool in both property and vehicle appraisals.

Why Drones in Appraisals Are Rising Fast

The push for drone appraisals in property and auto claims comes down to:

- Efficiency: Inspections that once took hours now take minutes.

- Safety: No roof climbs or entering dangerous accident zones.

- Proof: Drone photos provide clear evidence that strengthens claims.

With drones, appraisers avoid unstable roofs, storm debris, and wrecked cars while still delivering detailed documentation.

DOWNLOAD: “Drones in Appraisals The New Tool Transforming Inspections”.PDF

How Often Are Drones in Appraisals Today?

Residential appraisals – Drones are common in luxury homes, unique roof designs, or high-value properties.

Commercial appraisals – Around 30–40% of large commercial appraisals rely on drones for warehouses, shopping centers, and industrial sites.

Vehicle appraisals – Still rare (under 10%), but rising in diminished value and total loss claims. Drones capture overhead crash images, frame damage, and accident scenes more clearly than traditional inspections.

If you’re exploring vehicle claims, check our diminished value claim calculator to estimate what your car may have lost.

When Drone Appraisals Make the Most Impact

- Rural or farmland properties needing wide coverage

- Steep or unsafe roofs where climbing is risky

- Disaster inspections after storms, floods, or fires

- Luxury homes requiring detailed visuals

- Vehicle accident scenes for diminished value and total loss claims

Benefits of Drone Appraisals

- Accuracy: Aerial photos, mapping, and precise measurements

- Safety: No roof climbs or risky accident zones

- Evidence: Drone photos strengthen insurance and legal claims

- Professional advantage: Appraisers using drones stand out as modern and thorough

Learn how this ties into independent vehicle appraisal services we provide.

The Hidden Challenges of Drone Appraisals

- FAA Part 107 license required for commercial use

- Weather limits – rain, wind, and snow can ground drones

- Privacy concerns – filming neighbors or bystanders may trigger disputes

- Cost barriers – Pro drones run $1,000–$3,000, plus liability insurance

For smaller homes or minor fender-benders, traditional total loss appraisal services may still be faster and more cost-effective.

Legal and Insurance Rules for Drones in Appraisals

- Liability: If a drone damages property, the appraiser is responsible

- Insurance use: Some insurers accept drone evidence, others prefer notes

- Airspace restrictions: No flights near airports, schools, highways, or restricted zones

- Privacy compliance: Footage must focus only on the subject property or vehicle

For broader context, visit the NAIC consumer insurance rights page.

The Future of Drones in Appraisals

By 2030:

- AI will merge with drones to create 3D models, repair estimates, and automated reports (NASA drone AI research)

- Over 50% of commercial appraisals may rely on drones

- 25–30% of residential appraisals expected to adopt them

- Vehicle drone appraisals will grow in diminished value and total loss cases

FAQs About Drones in Appraisals

Do insurers accept drone evidence?

Yes. Many insurers now accept drone photos for diminished value and total loss claims.

Are drones replacing appraisers?

No. Drones collect data, but appraisers analyze and assign value.

How much do drones cost?

Pro models cost $1,000–$3,000 plus training and insurance.

Can drones be used everywhere?

Not always. Weather, privacy, and FAA rules may restrict usage.

So Why Drones in Appraisals Matter Now?

Fewer than 20% of inspections currently use drones, but the benefits are undeniable. Drones provide proof, precision, and protection in both property and vehicle claims.

They are especially valuable in diminished value claims, total loss appraisals, and large property inspections. As costs fall and rules adapt, drones will shift from rare to routine.

👉 Appraisers and insurers who adopt drone technology early will lead the market. For more updates, check our Auto News blog.