In the fast-paced world of electric vehicles, Tesla recently encountered a surprising twist. The company, known for its groundbreaking approach in the EV sector, saw its stock take a downturn after the Q4 earnings report fell short of expectations. This report not only revealed a shortfall in the anticipated financial figures but also cast a shadow on Tesla’s production growth outlook for the forthcoming year. This development marks a notable shift for Tesla, a company typically synonymous with rapid growth and market disruption. In this comprehensive analysis, we’ll explore the intricacies of Tesla’s Q4 performance, uncovering aspects often overlooked by mainstream coverage, and assess what these developments mean for Tesla’s future trajectory.

What Tesla’s Q4 Earnings Say About Its Future (PDF).

Q4 Earnings Analysis: Behind the Numbers

Tesla’s Q4 revenue reached $25.17 billion, falling short of the expected $25.87 billion. Despite this, the revenue showed a 6% increase from the previous year. However, the real story unfolds in the details of Tesla’s profitability. The company reported an adjusted EPS of $0.71, marginally below the $0.73 forecast, and an adjusted net income of $2.486 billion, slightly missing the anticipated $2.61 billion.

The Margin Squeeze

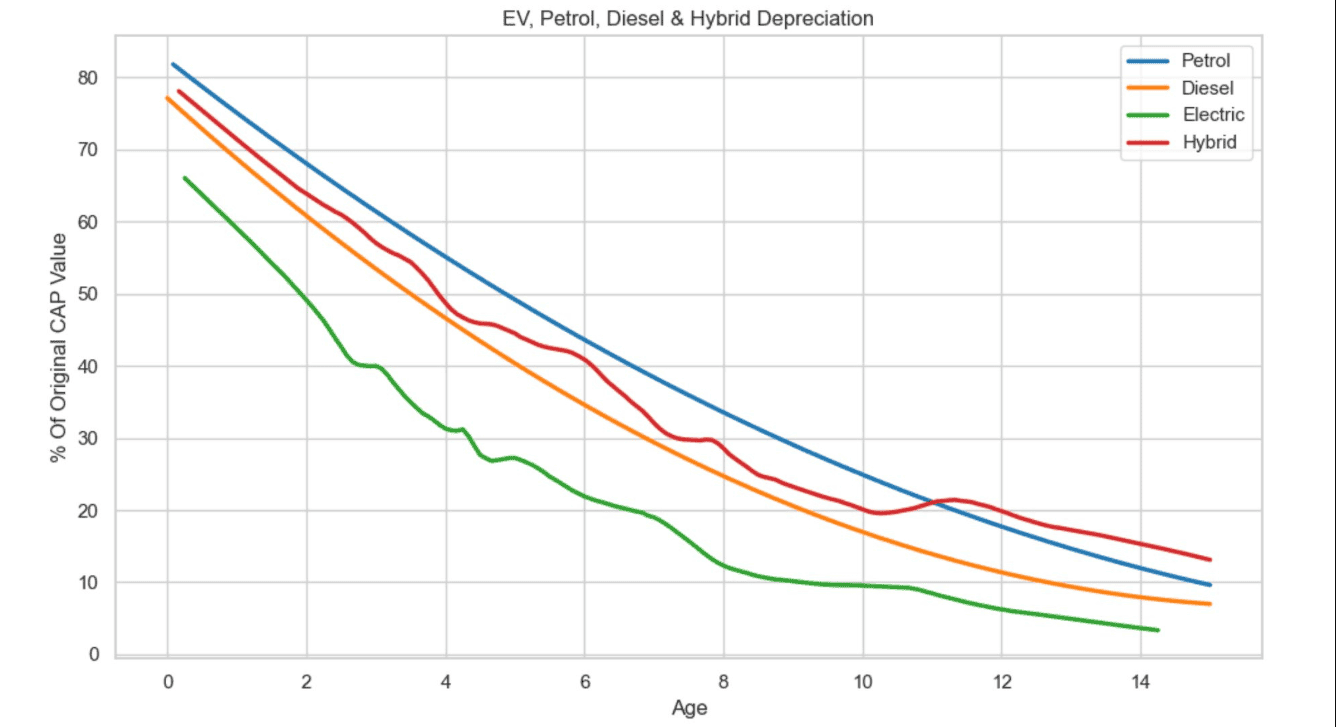

A closer look reveals that Tesla’s gross margin for Q4 stood at 17.6%, compared to an 18.1% estimation. This figure not only represents a year-over-year decline but also a sequential drop from 17.9% in Q3. Such a margin contraction suggests that Tesla’s late 2022 cost-cutting initiatives might be taking a toll on its profitability.

Future Production Prospects

Tesla’s statement on its expected vehicle volume growth rate for the upcoming year is particularly striking. The company anticipates a “notably lower” growth rate than in 2023, attributing this to the efforts surrounding the launch of their next-generation vehicle at Gigafactory Texas. This announcement casts doubt on reaching the previously projected 2.19 million vehicles for 2024, a figure that would have marked a 21% increase from 2023.

Gen-2 Platform Developments

Tesla’s mention of progress on its gen-2 platform offers a silver lining. The company is aggressively pushing to bring this new platform to market, starting production at Gigafactory Texas. This platform, poised to revolutionize vehicle manufacturing, underscores Tesla’s commitment to innovation. Notably, Reuters reports Tesla’s plans to begin producing a new mass-market EV, codenamed “Redwood,” by mid-2025.

External Pressures and Delivery Milestones

Tesla’s stock decline can also be attributed to external factors such as Hertz’s shedding of thousands of EVs, price cuts in China, a production halt in Berlin, and CEO Elon Musk’s demands for more stock. However, it’s worth noting that Tesla reported a record Q4 with 484,507 deliveries, surpassing estimates and marking a significant milestone.

Yearly Growth and Challenges

Over the year, Tesla achieved a 38% growth in vehicle deliveries, totaling 1.81 million, and a 35% increase in production. Although these figures fall short of the 50% CAGR target, they highlight Tesla’s resilience amid factory shutdowns and improvements.

The Cybertruck Enigma

Tesla’s silence on Cybertruck deliveries in the Q4 update is intriguing. The company hints at a longer production ramp for the Cybertruck compared to other models, adding an element of uncertainty to its future rollout.

Elon Musk’s Ambitions and Investor Concerns

A potential wildcard in Tesla’s trajectory is CEO Elon Musk’s recent statements regarding his stake in the company. Musk expressed a desire for greater control over Tesla to fulfill its AI ambitions, suggesting a need for a new stock-based compensation plan. This stance has sparked concerns among investors and analysts, who fear that Musk’s potential creation of a separate AI company could detract from Tesla’s core mission.

Analyst Perspectives

Industry experts, like Wedbush analyst Dan Ives, view Tesla as a disruptive tech leader. However, Ives warns that Musk’s potential departure to focus on separate AI projects could significantly impact Tesla’s narrative.

Conclusion

As we reflect on Tesla’s latest financial disclosures, we’re presented with a narrative that is as intricate as it is pivotal. Tesla, a titan in the realm of electric vehicles, finds itself at a crossroads. The Q4 earnings reveal a tapestry of contrasts: impressive strides in innovation and market presence are juxtaposed against emerging challenges in profitability, production strategy, and executive decision-making. Looking ahead to 2024, the eyes of investors, industry observers, and Tesla aficionados will be fixed on how the company maneuvers through these turbulent waters. This period will not only test Tesla’s resilience but also its ability to sustain its pioneering status in an increasingly competitive and dynamic market.