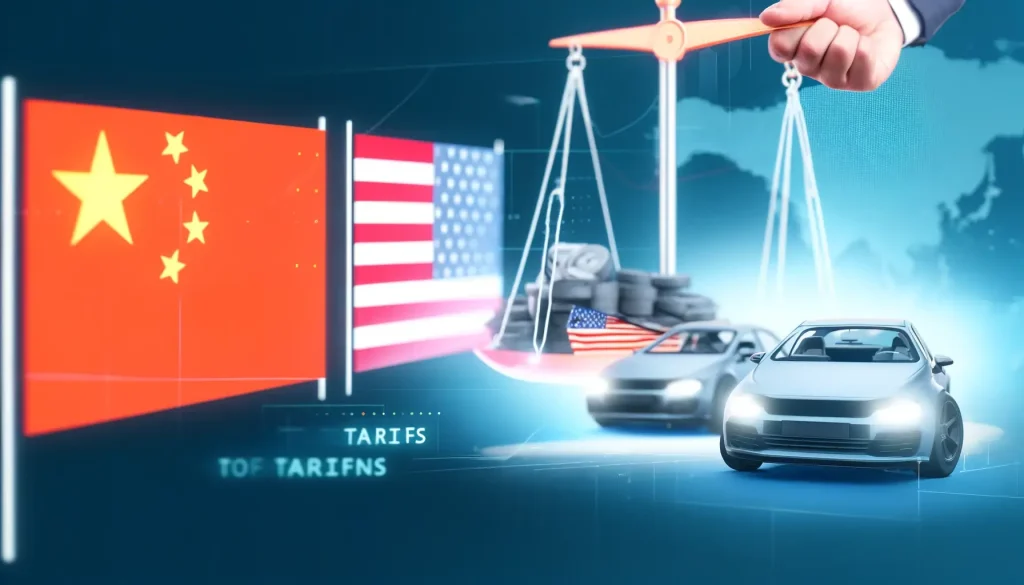

China’s retaliation is intensifying against increased anti-China tariff moves by the United States and the European Union (EU). The possibility of China raising tariffs on imported cars is not just a headline—it’s a potential game-changer in the world of global trade.

“We have received information from internal sources from mainland China that China may consider raising temporary tariff rates on imported vehicles with large internal combustion engines,” the Chinese Chamber of Commerce in the EU said in a statement on May 21, according to Hong Kong’s South China Morning Post (SCMP) and other sources.

Liu Bin, a representative of the China Automotive Strategic Policy Research Center, indicated to the government-run Global Times that the import tariffs on large internal combustion engine vehicles could be increased from the current 15 percent to 25 percent.

China Plans to Raise Tariffs on US and EU Cars (PDF)

The Bigger Picture

China’s move is seen as a response to anti-China pressure from the United States and the EU. The United States announced last week that it would significantly increase import tariffs on key Chinese goods including Chinese electric vehicles (25 to 100 percent) and semiconductors (25 to 50 percent). The EU is also expected to raise import duties to 25 percent from the current 10 percent in July at the latest after completing an anti-subsidy investigation into Chinese electric vehicles.

China launched an anti-dumping investigation into Taiwanese, U.S., EU, and Japanese polyoxymethylene (POM) over the weekend, following an investigation of imported brandy at the beginning of this year. If the Chinese government raises tariffs on imported cars, it will reflect an escalation of retaliatory measures by the Chinese government.

On the same day, China announced sanctions on 12 U.S. defense contractors, including Lockheed Martin, and their executives for arms sales to Taiwan. The previous day, China had added Boeing and others to its sanctions list and imposed fines on them.

The Implications

Against this backdrop, the United States wants to strengthen its cooperation with Europe in order to hold China in check. “China’s industrial policy may seem remote as we sit here in this room, but if we do not respond strategically and in a united way, the viability of businesses in both our countries and around the world could be at risk,” said U.S. Treasury Secretary Janet Yellen who was visiting Germany. Yellen is also likely to bring up trade with China as a key issue at this week’s meeting of Group of Seven (G7) finance ministers in Italy.

The EU is in a complicated situation. It fears a flood of cheap Chinese goods into Europe after China fails to export them to the United States, but it also fears Chinese retaliation if the EU actively sides with the United States. “I don’t think that the EU and China are in a trade war,” said EU Commissioner Ursula von der Leyen who said that the EU sympathizes with U.S. concerns about Chinese overproduction. “We have a different approach and a much more customized approach.”

What’s Next?

If China follows through with the tariff increases on imported cars, it won’t be a standalone measure but part of a comprehensive strategy. This strategy encompasses various economic actions and trade limitations designed to counteract Western pressure. The ripple effects on global supply chains, international relations, and economic policies will be significant. Companies in the automotive industry, especially those dependent on exports to China, should prepare for a challenging period ahead.

Wrapping Up

In conclusion, the potential tariff hikes by China on imported cars from the US and EU are more than just a tit-for-tat trade maneuver. They signify a deepening rift in international trade relations that could reshape economic landscapes. Businesses and policymakers alike must stay vigilant and adaptive to these evolving dynamics.

Will the world see a de-escalation of these trade tensions anytime soon, or are we headed for an all-out trade war?