In an unexpected move that’s caught the attention of electric vehicle enthusiasts and market analysts alike, Tesla has announced a temporary price reduction for some of its Model Y models in the United States. This decision, particularly intriguing for its timing and implications, raises questions and opportunities for potential buyers and industry watchers. Let’s dive into what this means, why it matters, and what unique insights emerge from Tesla’s latest strategy.

How to Benefit from Tesla Model Y’s Limited-Time Price Cut (PDF)

Understanding Tesla’s Price Adjustment

A Brief Overview

In a move that’s stirred considerable interest, Tesla has reduced the prices of its Model Y rear-wheel drive and Model Y Long Range variants by $1,000, bringing them down to $42,990 and $47,990, respectively. This adjustment marks a 2.3% and 2% discount from their previous prices. It’s worth noting that this discount is valid only for February, with the prices set to rebound by at least $1,000 starting March 1. Interestingly, the price of the Model Y Performance variant, along with other Tesla models, remains unchanged.

Behind the Timing

This price cut comes on the heels of a similar reduction in Germany and amidst a backdrop of broader industry challenges. Just last month, Tesla faced production hiccups at its Berlin factory due to component shortages, triggered by shipping disruptions in the Red Sea. Furthermore, Tesla’s announcement in January about expected “notably lower” sales growth this year, amid efforts to ramp up production of its next-gen electric vehicle, code-named “Redwood,” provides context to the price cuts. These reductions are not just a response to immediate market conditions but a strategic move in a fiercely competitive landscape.

The Broader Context: Market Dynamics and Strategic Implications

A Cooling Demand?

Tesla’s price adjustments arrive at a time when the EV market is witnessing a cooling demand and heightened competition. With the rise of affordable electric vehicles, particularly from Chinese manufacturer BYD—which recently eclipsed Tesla in global EV sales—the market dynamics are shifting. Tesla’s price cut could be a tactic to maintain its competitive edge and appeal in a rapidly evolving market.

The Impact on Tesla’s Margins

The decision to lower prices, especially in a price-sensitive market like EVs, is bound to have implications for Tesla’s profit margins. Already squeezed by an ongoing price war, these cuts could further pressure Tesla’s financials. Yet, Tesla’s bold move suggests a long-term strategy that prioritizes market share and volume over short-term profitability.

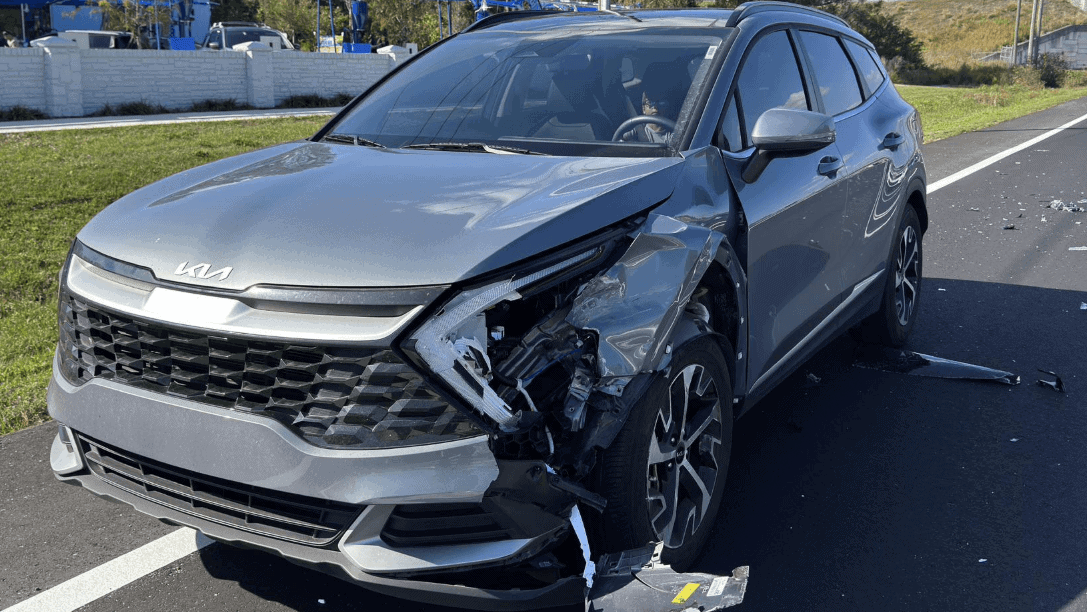

The Rental Market’s Reaction

An interesting subplot in the EV narrative is the rental market’s response to the evolving EV landscape. Hertz Global Holdings’ decision to sell approximately 20,000 electric vehicles, including Teslas, citing higher collision and damage expenses, points to the complex calculus rental firms are making regarding EVs. This development, alongside Tesla’s price cuts, underscores the broader challenges and transitions within the automotive industry.

Conclusion: Navigating a Shifting Landscape

Tesla’s temporary price reduction for select Model Y models is more than a mere pricing strategy; it’s a reflection of the broader challenges and opportunities within the electric vehicle market. As Tesla navigates cooling demand, increased competition, and the intricacies of producing its next-generation vehicles, these price adjustments serve as a strategic tool in its arsenal.

For potential buyers, this presents a timely opportunity to invest in a Tesla Model Y at a reduced cost. For industry watchers, it’s a fascinating moment to observe how one of the most influential players in the EV space adapts to a rapidly changing market landscape. As the EV market continues to evolve, Tesla’s moves will undoubtedly remain a key point of interest, offering insights into the future of transportation.

In a market where every percentage point in price adjustment can signal broader strategic shifts, Tesla’s latest move is a compelling chapter in the ongoing story of electric mobility.